Here are the top Venture Capital Firms in Asia that are investing in early-stage startups

- 1.Here are the top Venture Capital Firms in Asia that are investing in early-stage startups

- 2.Top Venture Capital Firms in Latin America Investing in Startups

- 3.The 45 (best) venture capital firms in the USA that literally want startups to pitch them

- 4.The Best Venture Capital Firms in Europe Currently Investing in Startups

In 2018 Venture Capital firms in Asia invested over $48 billion in up and coming startups.

Are you interested in getting a piece of that action?

If so, we’ve put in the work to create a roundup of the top 26 venture capital firms in Asia, categorized by country.

We’ve included:

- Information on how to apply

- As much information as we could find on how much money they usually invest

- Contact information

- Any other trivia we thought was important for you to know

Good luck pitching!

VCs in China

China Growth Capital

Why you need to know:

- Founded in China in 2006.

- Usually invest in early stage companies.

- Focus is mainly on fintech, enterprise software, frontier technology and marketplace companies that move the needle.

- CGC exclusively supports Chinese companies.

- Their portfolio contains both popular names such as Wish, and companies like Shen Me Zhi De Mai, Tiger Brokers, BeyondHost and DeePhi that have a strong presence in global stock markets.

- CGC will also assist your company with go-to-market strategy, talent acquisition, opinion leadership marketing, and customer referral.

How much they usually invest:

- Initial ticket at $1M, up to $15M per company.

- They specialize in seed and early venture, but will invest up to a series B.

- Total fund size of $1.1 billion (combining their RMB and USD funds).

How to apply:

- Click the “Contact Us” button on their homepage

Qiming Venture Partners

Why you need to know:

- One of China’s leading venture capital firms, Qiming was founded in China in 2006.

- Currently they have presence in 5 cities in China and raised their first US fund in 2017.

- Although they invest in many early stage companies (over 50% of their companies), they can also come in at expansion stage.

- Their focus sectors are healthcare, information technology, clean technology as well as the intersection of internet and consumer (“Intersumer”)

- Qiming’s RMB funds are exclusively focused on Chinese companies, but if your company is US based, it’s worth checking out their funds in Boston, Seattle and Palo Alto.

- Over 50 of Qiming’s portfolio companies are already listed on stock exchange markets or achieved exits through mergers and acquisitions . Industry unicorns such as Xiaomi and UBTech are also part of their portfolio.

How much they usually invest:

- They don’t publicly specify an initial ticket but their investments usually hard cap at $334M per sector.

- Between their RMB funds and their US funds, they handle a collective portfolio of $4 billion.

How to apply:

- Write to them at [email protected] or visit this page for their regional offices in China.

VCs in India

Accel

Why you need to know:

- A behemoth of a VC, Accel funds companies through all phases of growth worldwide.

- Facebook, Slack, Atlassian, Dropbox and Spotify are among their portfolio companies.

- They have a big focus on SaaS, but their portfolio includes companies in the security, consumer, developer and marketplace sectors.

- They have two hubs in the US, one in London and one in Bangalore, but they’re also funding companies outside these countries.

- Most notable exit from their India fund is Flipkart Group, India’s leading e-commerce marketplace. The Accel-led $800K seed in 2008 led to a $4B+ in cash investment in 2017 and being acquired by Walmart in 2018.

How much they usually invest:

- No data available on initial ticket, but in India they have funded up to $1M on a seed stage per company.

- Their India fund invests in both early and late stage companies.

- Their original fund for India started at $350M in 2016.

How to apply:

- Contact their Bangalore office through this page.

Kalaari Capital

Why you need to know:

- Launched in 2006, Kalaari Capital has invested in 147 companies.

- Early stage founders.

- They have a broad spectrum of sectors they invest in, from e-commerce and fintech to edtech, enterprise software and media.

- Focusing solely on Indian companies and supporting local entrepreneurship.

- Portfolio companies include Curefit, Urban Ladder and Myntra.

- Through their seed program, Kstart, they help the next generation of Indian startups grow.

How much they usually invest:

- No specified initial ticked but they have been known to invest $8M on seed investment.

- Doing mostly seed investments but they have done up to a Series D (for Curefit).

- $650 million in total assets under management.

How to apply:

- Email them at [email protected] or apply for their seed program here.

VCs in Japan

East Ventures

Why you need to know:

- The seventh most active seed investor worldwide with offices in Tokyo, Singapore and South Jakarta, East Ventures has invested in 138 companies in Southeast Asia.

- Early stage with a focus on founders.

- Broad spectrum of investments, from Agriculture and Big Data to Fintech and SaaS.

- They’re focusing on companies from Southeast Asia and Japan.

- 27 of their portfolio companies have exited, with the biggest exit being the acquisition of Kudo by Grab for (reportedly) over $100M.

- They’re also affiliated with EV Growth in Indonesia and have a joint accelerator program with YJ Capital, Coderepublic Accelerator.

How much they usually invest:

- No information on the initial ticket

- Mostly seed round and series A, but have also contributed (as non-lead investors) up to a series B.

- Their total fund size is $102.5M, whereas their portfolio companies have cumulatively raised $3.5 billion.

How to apply:

- Click on the “apply” button on the homepage and fill in the form.

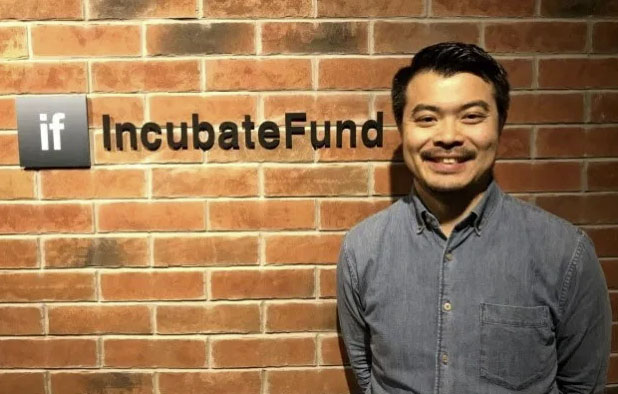

Incubate Fund

Why you need to know:

- Incubate Fund is the largest independent early stage VC in Japan, having invested in over 300 startups.

- Focusing on seed/early stage startups.

- Sectors are gaming, adtech, fintech, frontier tech, enterprise and consumer/ecommerce.

- Investing in Japanese companies.

- 13 of their portfolio companies have exited.

- They also host “Incubate Camp”, which is a seed acceleration program for earlier stage entrepreneurs.

How much they usually invest:

- No information on an initial ticket.

- Mostly invest in seed rounds, but have participated up to a series D (as non-lead investors).

- Total fund size of $440M.

How to apply:

- Fill in their contact form here.

VCs in Indonesia

East Ventures

Why you need to know:

- East Venture’s South Jakarta branch is one of the most important VC players in the country.

- Early stage with a focus on founders.

- Broad spectrum of investments, from Agriculture and Big Data to Fintech and SaaS.

- They’re focusing on companies from Southeast Asia and Japan.

- 27 of their portfolio companies have exited, with the biggest exit being the acquisition of Kudo by Grab for (reportedly) over $100M.

- They’re also affiliates with EV Growth in Indonesia and have a joint accelerator program with YJ Capital, Coderepublic Accelerator.

How much they usually invest:

- No information on initial ticket.

- Mostly seed round and series A, but have also contributed (as non-lead investors) up to a series B.

- Their total fund size is $102.5M, whereas their portfolio companies have cumulatively raised $3.5 billion.

How to apply:

- Click on the “apply” button on the homepage and fill in the form.

Venturra Capital

Why you need to know:

- Venturra Capital primary invests in internet companies that are on the cusp of international expansion.

- Focus is in early stage/high growth.

- Sectors of investment include fintech, e-commerce, healthcare and education and marketplaces.

- Although located and with primarily focus in Indonesia, they invest in companies across Asia.

- Their most notable exit is BrideStory, a Southeast Asia wedding marketplace.

- Their Venturra Discovery fund handles seed investments whereas the Venturra Fund I handles Series A and beyond.

How much they usually invest:

- During seed stage, the initial ticket range can be anything from $200,000 to $2M.

- Investing primarily in seed but have participated in up to a series C.

- Venturra Capital has raised a total fund of $150M.

How to apply:

- Fill in their investment proposal form here.

VCs in the Philippines

Narra Venture Capital

Why you need to know:

- Narra Venture Capital is a venture management and advisory group with offices in The Philippines, Indonesia, Singapore, Hong Kong and Malaysia.

- Investing in both early and late stage companies.

- Sectors include SaaS, electronic manufacturing services, information systems and design services.

- Focusing on companies in the Philippines but also invest all around Asia.

- Narra works with Silicon Valley based partners like Tallwood Venture Capital and are also affiliated with BGN Ventures, Inc.

How much they usually invest:

- Initial ticket around $500K.

- Narra does seed investments but have participated (as non-lead investors) up to a series D.

- They have secured a total funding of $2.6M.

How to apply:

- Call them at +63 (2) 552-1175 (from the Philippines) or at +1 (650) 331-1134 (from the US).

Kickstart

Why you need to know:

- A fully-owned subsidiary of Globe Telecom, Kickstart offers investment and resources to technopreneurs in the Philippines.

- Focusing on early-to-growth stages.

- Investing in tech startups.

- They’ve backed companies in the Philippines, Singapore, Indonesia, Malaysia, the United States, Canada, and Israel.

- Besides capital, they also offer access to mentors and talent, facilities and resources.

How much they usually invest:

- Depends on the company and the needs, but a seed round can be anything from $550K to $1.6M.

- They’re doing anything from venture rounds to series C.

- Currently operating as fund managers for a $150M Ayala Corp fund.

How to apply:

- Fill in a form with your pitch here.

VCs in Vietnam

VinaCapital Ventures

Why you need to know:

- A Vietnam-focused VC platform launched in 2018, supporting “entrepreneurs with big ideas” and helping them create impact on a local and regional level.

- They work mostly with early stage companies.

- Focus is on technology and digital applications, mostly working with engineers, scientists and innovators.

- They invest in Vietnamese and Southeast Asia companies.

- They are the venture capital arm of asset management company VinaCapital.

How much they usually invest:

- No information is available on how much they invest as an initial ticket.

- So far, they’ve been lead investors in venture rounds, seed rounds, and Series A.

- They operate a fund of $100M.

How to apply:

- Fill in the “contact us” form on their homepage.

Inspire

Why you need to know:

- A partner-funded venture investor and builder, Inspire has a strong presence in Vietnam (as well as in Thailand and Indonesia).

- Early stage/high growth.

- Mostly e-commerce, marketing, digital media and education.

- Focus is in Southeast Asia companies, emphasis on localization.

- No notable exits yet.

- They also operate Venture Labs Group, which is a venture builder, co-founder and operating partner for companies who want to expand to Asia.

How much they usually invest:

- Average initial investment ranges from $300K-$500K.

- They’re doing mid-seed and late-seed, as well as series A and later stages.

- Operating a $25M fund.

How to apply:

- Drop them a line at [email protected]

VCs in Thailand

Beacon VC

Why you need to know:

- Founded in 2017, Beacon VC is owned by a leading commercial bank in Thailand, Kasikornbank PLC.

- They’re focusing in early stage-to-growth investments.

- Backing technology startups in sectors such as fintech, consumer internet, enterprise IT and AI.

- They are focused on ideas, not location — so they invest globally, but with a priority to companies looking to expand in Thailand and Southeast Asia.

- No exits yet.

How much they usually invest:

- They don’t usually disclose their initial investments.

- Mostly leading and participating in seed rounds and Series A but they have participated in up to a Series H!

- A total fund size of $135M

How to apply:

- Networking is essential, as they prefer taking on companies who have been introduced by one of their investors, their founder or their extended network. But you can also email at [email protected]

Singha Ventures

Why you need to know:

- The corporate venture capital unit of Singha Corporation launched in 2019 to back startups with potential.

- Early stage founders.

- Their main sectors are e-commerce, marketplace and B2B solutions, but they also invest in consumer and SaaS.

- Focusing on startups from Thailand first, but also open to investing globally.

- No exits yet.

- They pledge to not invest more than a 25 per cent stake (per startup) in the initial stage, to allow the startup owners to run their own companies.

How much they usually invest:

- No information on initial investments, but they have invested between $10M-$22M on later rounds.

- So far, they have participated in Series B and Series C.

- They have raised a total fund size of $25M.

How to apply:

- Fill in the contact form on their homepage.

VCs in South Korea

SoftBank Ventures Asia

Why you need to know:

- Active since 2000, SoftBank Ventures Asia has invested in more than 250 companies.

- Backing early stage startups.

- Focus sectors include AI, IoT and smart robotics.

- SoftBank Ventures Asia is geared towards helping local companies reach the global market.

- 11 of their portfolio companies have exited, the most notable of which being machine learning platform Arraiy, online wallet Korbit, and software service Between.

How much they usually invest:

- No information on a standard initial ticket, but they have led seed rounds with $2.1M.

- Anything from venture rounds to series D.

- Currently handling a total fund size of $1.1 billion spread across 15 funds.

How to apply:

- Email them at [email protected]

Korea Investment Partners

Why you need to know:

- Active since 1986, the leading VC firm has its HQ in Seoul but they also operate from their offices in Shanghai, Beijing and Sunnyvale.

- Invest in all stage companies.

- Broad sector focus, from pharmatech to gaming and marketing.

- Backing companies regardless of location.

- Some of their most notable exits include Finnish gaming platform Seriously, Inovio Pharmaceuticals and influencer marketing network Gushcloud International.

- They have invested in more than 600 companies.

How much they usually invest:

- Their seed rounds can range from $2M-$6M.

- They have led or participated in everything from seed rounds to post-IPO debt.

- A total fund of $2.5 billion.

How to apply:

- Contact their regional offices through this page for more information.

VCs in Taiwan

UMC Capital

Why you need to know:

- The direct investment arm of semiconductor foundry UMC, UMC Capital has four offices around the world and are listed both on the New York Stock Exchange and the Taiwan Stock Exchange.

- Backing companies from seed stage all the way to Pre-IPO and market investments.

- Sectors of focus include automotive, AI, digital health, IoT, industrial automation and semiconductors.

- Investing primarily in companies in Taiwan, China and the US.

16 of their companies have exited, most notably open-source software Nexenta Systems, big data Alpine Data Labs, and SaaS Fuhu. - They are touting themselves as “patient capital”, pledging to sustain their support during a downturn.

How much they usually invest:

- No information on initial investment range.

- They are flexible, investing in all stages.

- Total fund size of $800M.

How to apply:

- Call their Taiwan office at +886 2 2658-7388.

Cherubic Ventures

Why you need to know:

- Around since 2014, Cherubic Ventures has helped more than 167 companies.

- Investing in early-stage venture, with a focus on seed rounds.

- Sectors of focus are Consumer, Enterprise Solutions, Healthcare, and Blockchain.

- Backing companies based in Greater China and the US.

- 16 of their companies have exited, most notably Hims & Hers, Wish, Siftery, and TalkIQ.

How much they usually invest:

- Initial ticket ranges from $0.5M to $1M.

- Mostly participating in seed rounds.

- A total fund size of $320.9M.

How to apply:

- Email them at [email protected]

VCs in Hong Kong

CITIC Capital Holdings

Why you need to know:

- The venture group of CITIC Capital Holdings, a leading investment management and advisory company in China, funds small-to-medium-sized enterprises.

- Both early and late stage investors.

- Sectors include finance and resources management, patent technology, software and engineering.

- Focus is in China-based companies.

- 10 of their companies have exited, with the Alibaba Group being the most notable.

- They also have an incubator, RMB fund, investing in Shenzhen area start-up Internet and TMT companies.

How much they usually invest:

- No information on initial investment range.

- Have led and participated in anything from series A to series C.

- Handling a total of $3.9 billion across 4 different funds.

How to apply:

- Fill in their inquiry form here.

MindWorks Ventures

Why you need to know:

- MindWorks Ventures is geared towards companies with a potential to build new ecosystems or reinvent industries — and they like to invest in them early.

- Early and expansion stage startups.

- Focusing mostly on disruptive consumer and enterprise technology.

- Working primarily with founders across Greater China, but also in Southeast Asia, Silicon Valley and the rest of the world.

- Mobile technology developer MoboTap is their first exited company.

How much they usually invest:

- No information on initial ticket range.

- They’ve led and participated in everything from seed rounds to series D.

- Handling a total fund of $142M.

How to apply:

- No contact information available on their website, but you can try messaging them on LinkedIn.

VCs in Singapore

Red Dot Ventures

Why you need to know:

- RedDot Ventures has a portfolio of about 30 startups, which they actively help with talent acquisition besides capital injections.

- Pre-seed stage investors.

- Focus sectors are AI, big data, clean technology, ICT, IoT, fintech, medtech, advanced industrial materials & manufacturing.

- Focuses on Singapore-based high-tech startups.

- Ascenz, a fuel consumption monitoring system, is the first of their portfolio companies to exit.

- They fast-track startups by providing access to financial partners for series A and above, legal and accounting advice, digital marketing and corporate secretary solutions, as well as software and cloud services.

How much they usually invest:

- No information on an initial ticket range.

- Mostly participating in seed rounds.

- They have a total of $450M in assets under management.

How to apply:

- Email them at [email protected].

Wavemaker Partners

Why you need to know:

- With headquarters in Los Angeles, USA, and Singapore, Wavemaker Partners have invested in over 300 portfolio companies.

- Early stage VC.

- Broader focus sectors are enterprise and deep tech.

- Investing primarily in Southeast Asia and the West Coast of the US.

- 38 of their portfolio companies have exited, most notably Phunware, Inc., SHIFT and Gushcloud International.

- They are the regional partner of the Draper Venture Network (DVN) for Southern California and Southeast Asia.

How much they usually invest:

- No information on an initial ticket range.

- Mostly leading and participating in seed rounds, but have invested up to a series B.

- They have a total of $335M in assets under management.

How to apply:

- They prefer introductions through mutual contacts but you can also submit your pitch to [email protected].

Qualgro

Why you need to know:

- Qualgro is a Venture Capital firm based in Singapore, investing mainly in B2B companies in Data, SaaS and Artificial Intelligence, to support talented entrepreneurs with regional or global growth ambition.

- Qualgro invests across Southeast Asia, Australia/NZ, primarily at Seed, Series A & B.

- Their unique, knowledge-based approach has been affirmed by Wavecell’s notable exit – which won them the VC Exit of 2019.

- They have two unicorns under their belt: Patsnap and Appier

How much they usually invest:

- Investment round range: US$2,000,000 to US$5,000,000

- Invests across seed, series A & B.

How to apply:

- Email them at [email protected]

VCs in UAE

BECO Capital

Why you need to know:

- Founded in 2012, BECO Capital supports and accelerates technology companies in the MENA region.

- Early stage and seed funding.

- They are exclusively geared towards technology enabled businesses.

- Operating exclusively in the MENA region, with a presence in 19 countries.

- 4 of their portfolio companies have exited, most notably app developer Careem, global marketplace JadoPado and productivity app Wrappup.

- Besides capital, they offer hands-on operational mentorship.

How much they usually invest:

- No information on initial ticket.

- They lead and participate in seed rounds up to series B.

- Have raised a total of $850M.

How to apply:

- Fill in their application form here.

Mubadala

Why you need to know:

- Established by the Abu Dhabi government and the Royal Family, Mubadala’s mission is to accelerate the nation’s growth through strategic investments.

- Investing in early stage companies.

- Focus sectors are diverse, including aerospace, technology, renewable sources and healthcare.

- Exclusively funding Abu Dhabi based companies.

- 2 of their portfolio companies have exited, most notably multi-asset mining company Equinox Gold.

How much they usually invest:

- No information on initial ticket range.

- Have led anything from series A to post-IPO.

- Handling a total fund of $1.4 billion.

How to apply:

- Fill in their application form here.

VCs in Qatar

Middle East Venture Partners

Why you need to know:

- Based in Lebanon, but with a strong presence in Qatar and the rest of the MENA region, MEVP invests in early and growth stages of local and regional companies.

Broad sector focus, mostly geared towards consumer technology, products and services.

The companies they invest in should be located within the MENA region.

2 of their portfolio companies have exited, most notably cloud-based development platform FuelPowered.

How much they usually invest:

- Each of their funds has a different initial ticket, ranging from $200K to $3M.

- Have led and participated in seed rounds up to series C.

- They have more than $312M in assets under management, across 4 different funds.

How to apply:

- Fill in the contact form and attach your business plan here.