Download our list of The Top 100 Venture Capital Firms

This free sheet contains 100 VC firms, with information about the countries, cities, stages, and industries they invest in, as well as their contact details.

Tenity

Tenity Accelerator in Zurich supports early-stage Fintech, Insurtech, Regtech, and Deeptech startups with incubation and acceleration programs. Offering CHF 50,000 for a 2.5% equity stake, it connects founders with top-tier mentors and investors, fostering innovation and collaboration in the global financial ecosystem.

Key Info

Number of Investments

295

Number of Exits

8

Industries

Fintech, Insurtech, Regtech, and Deeptech

Investment Stage

Convertible Note, Early Stage Venture, Seed

Year Founded

2015

CB Rank

78,593

SICTIC

SICTIC is Switzerland's leading angel investor network, connecting early-stage tech startups with over 500 smart money investors. Founded in 2014, it organizes regular Investor Days and provides free resources for startups, facilitating substantial funding and growth within the Swiss tech ecosystem.

Key Info

Number of Investments

203

Number of Exits

14

Industries

ICT, Fintech, Insurtech, Healthtech, Medtech, and other deep tech sectors

Investment Stage

Convertible Note, Debt, Early Stage Venture, Late Stage Venture, Seed, Venture

Year Founded

2014

CB Rank

147,568

Lakestar

Lakestar, founded by Klaus Hommels, invests in early to growth-stage tech startups across Fintech, Deep Tech, digitalization, and Healthcare. With offices in London, Berlin, and Zurich, Lakestar supports visionary entrepreneurs through extensive resources and networks, fostering innovation and technological advancements globally.

Key Info

Number of Investments

171

Number of Exits

27

Industries

Fintech, Deep Tech, digitalization, and Healthcare

Investment Stage

Convertible Note, Debt, Early Stage Venture, Late Stage Venture, Private Equity, Seed, Venture

Year Founded

2012

CB Rank

60,252

Redalpine

Redalpine, a Zurich-based venture capital firm, focuses on seed and early-stage investments in ICT, HealthTech, AI, and sustainability sectors. With over €1 billion in assets under management, it supports game-changing startups like N26 and Taxfix, providing financial backing, expertise, and a robust network.

Key Info

Number of Investments

147

Number of Exits

13

Industries

ICT, HealthTech, AI, and sustainability

Investment Stage

Crowdfunding, Early Stage Venture, Late Stage Venture, Seed, Venture

Year Founded

2006

CB Rank

77,364

Swisscom Ventures

Swisscom Ventures, the venture capital arm of Swisscom, invests in early to growth-stage startups focusing on IoT, Cybersecurity, Fintech, and AI. Founded in 2007, it supports over 70 portfolio companies with strategic backing and access to Swisscom’s extensive ecosystem, driving digital transformation technologies.

Key Info

Number of Investments

136

Number of Exits

38

Industries

IoT, Cybersecurity, Fintech, and AI

Investment Stage

Convertible Note, Early Stage Venture, Late Stage Venture, Seed, Venture

Year Founded

2005

CB Rank

150,029

Mountain Partners

Mountain Partners, a global investment firm founded in 2005, invests in early to growth-stage startups across Internet & Technology, Fintech, and HealthTech sectors. With a presence in Zurich and over 200 portfolio companies, it offers operational support and a vast network, emphasizing sustainable and impactful investments.

Key Info

Number of Investments

122

Number of Exits

31

Industries

Internet & Technology, Fintech, and HealthTech

Investment Stage

Early Stage Venture, Seed, Venture

Year Founded

2005

CB Rank

155,652

UBS

UBS Venture Capital supports fintech and tech startups with funding and strategic resources. By focusing on financial technologies and digital innovations, UBS aims to foster growth and collaboration within the financial sector, enhancing its investment portfolio and driving advancements in fintech solutions.

Key Info

Number of Investments

111

Number of Exits

27

Industries

Financial technologies and Digital innovations

Investment Stage

Convertible Note, Debt, Late Stage Venture, Post-Ipo, Private Equity, Secondary Market, Venture

Year Founded

1862

CB Rank

207

Business Angels Switzerland (BAS)

Business Angels Switzerland (BAS), founded in 1997, is a non-profit association offering financing and coaching to Swiss startups. Focused on seed and early-stage investments across diverse sectors, BAS provides valuable networking opportunities and resources through regular events, fostering a robust startup ecosystem.

Key Info

Number of Investments

85

Number of Exits

3

Industries

ICT, MedTech, and Cleantech

Investment Stage

Early Stage Venture, Seed

Year Founded

1997

Nextech Invest

Nextech Invest, founded in 1998 and based in Zurich, specializes in oncology-focused venture capital. Supporting emerging biotechnology companies worldwide, Nextech provides hands-on assistance through critical scientific validation phases, fostering the development of transformative cancer medicines with a robust scientific advisory team.

Key Info

Number of Investments

83

Number of Exits

37

Industries

Biotechnology

Investment Stage

Early Stage Venture, Late Stage Venture, Post-Ipo, Private Equity, Venture

Year Founded

1998

CB Rank

142,741

Emerald Technology Ventures

Emerald Technology Ventures, founded in 2000 and based in Zurich, invests in industrial technology and sustainability sectors. With a focus on energy, water, advanced materials, and agriculture, Emerald offers strategic support and connects startups with corporate partners, maintaining a global presence and a successful investment track record.

Key Info

Number of Investments

77

Number of Exits

12

Industries

Energy, Water, Advanced Materials, and Agriculture

Investment Stage

Early Stage Venture, Late Stage Venture

Year Founded

2000

CB Rank

104,130

Blue Horizon Corporation

Blue Horizon Corporation, founded in 2016 and based in Zurich, focuses on sustainable food and agriculture investments. By investing in companies promoting alternative proteins and sustainable food systems, Blue Horizon aims to transform the global food industry, providing strategic guidance and extensive industry networks to drive positive environmental and social change.

Key Info

Number of Investments

76

Number of Exits

3

Industries

Agriculture, Farming, Finance, Financial Services, Food and Beverage, Food Processing, Sustainability, Venture Capital

Investment Stage

Convertible Note, Early Stage Venture, Late Stage Venture, Private Equity, Seed, Venture

Year Founded

2016

CB Rank

336,982

Founderful

Founderful, a Zurich-based pre-seed VC firm, focuses on supporting Swiss tech startups with founder-friendly, hands-on investments. Rebranded from Wingman Ventures in 2024, it raised $85 million for its second fund, targeting $120 million, and has backed over 50 startups across sectors like B2B software, AI, and industrial tech.

Key Info

Number of Investments

66

Number of Exits

3

Industries

B2B Software, Industrial Tech, AI, Robotics

Investment Stage

Early Stage Venture, Seed

Year Founded

2019

CB Rank

96,439

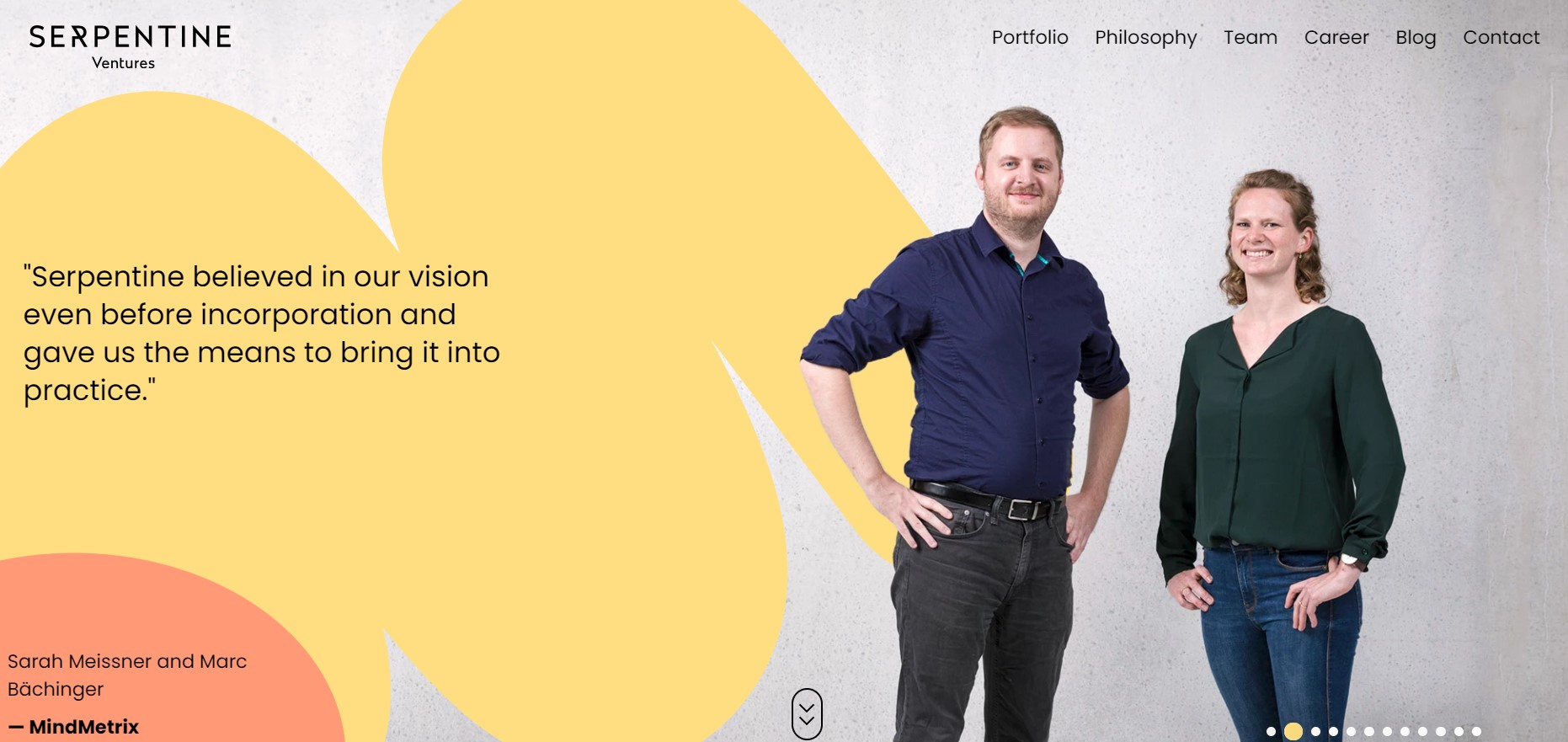

Serpentine Ventures

Serpentine Ventures focuses on early-stage investments across ICT, Fintech, Medtech, and Cleantech sectors. The firm provides strategic support and valuable industry connections, fostering innovation and growth within Switzerland's startup ecosystem and beyond.

Key Info

Number of Investments

66

Number of Exits

2

Industries

ICT, Fintech, Medtech, and Cleantech

Investment Stage

Early Stage Venture, Seed, Venture

Year Founded

2019

responsAbility Investments

responsAbility Investments, founded in 2003 and based in Zurich, focuses on impact investing in emerging markets. With over $3 billion in assets, it invests in sectors like financial inclusion, agriculture, and renewable energy, aiming to create significant social and environmental impact.

Key Info

Number of Investments

48

Number of Exits

6

Industries

Financial Inclusion, Agriculture, and Renewable Energy

Investment Stage

Debt, Early Stage Venture, Late Stage Venture, Post-Ipo, Private Equity, Secondary Market, Venture

Year Founded

2003

CB Rank

4,431

Technology Fund

The Technology Fund, a Swiss government-backed initiative, provides loan guarantees to innovative SMEs in cleantech, energy efficiency, sustainable mobility, and resource management. Aiming to promote sustainable technologies and reduce the carbon footprint, it supports companies with high innovation potential and environmental benefits.

Key Info

Number of Investments

45

Number of Exits

4

Industries

Cleantech, Energy Efficiency, Sustainable Mobility, and Resource Management

Investment Stage

Debt, Early Stage Venture, Seed

Year Founded

2014

CB Rank

207,812

Übermorgen Ventures

Übermorgen Ventures invests in early-stage climate-tech startups. The firm focuses on clean energy, carbon capture, and sustainable agriculture, providing strategic and operational support. Led by experienced entrepreneurs, Übermorgen Ventures aims to mitigate climate change through innovative solutions.

Key Info

Number of Investments

36

Industries

Clean Energy, Carbon Capture, Sustainable Agriculture

Investment Stage

Early Stage Venture, Seed

Year Founded

2019

EquityPitcher Ventures

EquityPitcher Ventures is a Swiss VC firm focusing on early-stage, tech-driven startups. It offers mentorship, strategic guidance, and network access to support innovative solutions and scalable business models. The firm emphasizes a hands-on approach to drive the success of its portfolio companies.

Key Info

Number of Investments

34

Number of Exits

1

Industries

Technology

Investment Stage

Early Stage Venture, Late Stage Venture, Seed, Venture

Year Founded

2016

CB Rank

162,582

Aravis Ventures

Aravis Ventures invests in early to growth-stage companies in the life sciences and renewable energy sectors. The firm provides strategic support and industry expertise, aiming to foster innovation and sustainable development within its portfolio companies.

Key Info

Number of Investments

30

Number of Exits

12

Industries

Biotechnology, Energy, Life Science, Renewable Energy

Investment Stage

Early Stage Venture, Late Stage Venture

Year Founded

2001

CB Rank

323,515

Swisscanto Private Equity

Swisscanto Private Equity, part of the Zurich Cantonal Bank Group, invests in mid-sized companies across various sectors. The firm provides financial and strategic support, aiming to drive long-term value and sustainable growth within its portfolio companies.

Key Info

Number of Investments

27

Number of Exits

2

Industries

Financial Services, Funding Platform

Investment Stage

Late Stage Venture

Year Founded

2018

CB Rank

1,134,672

Laser Digital

Laser Digital, a Swiss venture capital firm, invests in early to growth-stage startups in the digital and technology sectors. Offering strategic guidance and access to extensive networks, Laser Digital aims to support innovation and drive digital transformation.

Key Info

Number of Investments

25

Industries

Web3

Year Founded

2022

CB Rank

123,012

Storm Global

Storm Global focuses on sustainable and impact investments in renewable energy, technology, and healthcare sectors. The firm provides strategic support and industry connections, aiming to create positive social and environmental impact through its investments.

Key Info

Number of Investments

24

Number of Exits

11

Industries

Renewable Energy, Technology, and Healthcare

Investment Stage

Early Stage Venture, Private Equity, Secondary Market, Seed

Year Founded

2017

CB Rank

1,435,107

Planven Entrepreneur Ventures

Planven Entrepreneur Ventures invests in B2B software companies across Cybersecurity, AI, Machine Learning, and Health Tech sectors. Headquartered in Zurich with offices in Tel Aviv, it manages over $300 million in assets, supporting startups from Seed to Series B stages with strategic and operational expertise.

Key Info

Number of Investments

23

Number of Exits

5

Industries

Cybersecurity, AI, Machine Learning, and Health Tech

Year Founded

2015

CB Rank

215,381

Tomahawk.VC

Tomahawk.VC, a Swiss venture capital firm, invests in early-stage tech startups in Europe and the United States. The firm focuses on SaaS, Fintech, and HealthTech sectors, offering hands-on support and strategic guidance to scalable and innovative business models.

Key Info

Number of Investments

23

Number of Exits

1

Industries

B2B, Blockchain, Financial Services, FinTech, Information Technology

Investment Stage

Early Stage Venture, Seed

Year Founded

2020

CB Rank

216,642

TX Ventures

TX Ventures, the venture capital arm of TX Group, invests in digital transformation and tech startups in MediaTech, Fintech, and E-commerce sectors. Focusing on Seed to Series A stages, TX Ventures offers strategic resources and access to TX Group’s extensive network to foster innovation and growth.

Key Info

Number of Investments

21

Industries

Blockchain, FinTech, InsurTech

Investment Stage

Early Stage Venture, Seed, Venture

CB Rank

163,622

Persistent

Persistent, a Swiss venture capital firm, focuses on sustainable and impact investments in CleanTech, Renewable Energy, and Social Enterprises. The firm provides strategic guidance and operational support, aiming to create positive environmental and social impacts through its portfolio companies.

Key Info

Number of Investments

21

Number of Exits

1

Industries

Financial Services

Investment Stage

Early Stage Venture

Year Founded

2012

L1D

L1 Digital, a venture capital firm, specializes in digital and blockchain technologies, investing in early to growth-stage startups. Offering strategic support and access to a network of industry experts, L1 Digital focuses on innovative and disruptive business models in the digital space.

Key Info

Number of Investments

20

Industries

Blockchain

Investment Stage

Late Stage Venture, Venture

Year Founded

2018

Helvetica Capital

Helvetica Capital, a Swiss private equity firm, invests in mid-sized companies in industrials, healthcare, and consumer goods sectors. Providing financial and strategic support, Helvetica Capital partners with management teams to drive growth and long-term value creation in Switzerland and neighboring countries.

Key Info

Number of Investments

21

Number of Exits

6

Industries

Healthcare, and Consumer Goods

Investment Stage

Early Stage Venture

Year Founded

2015

FiveT Fintech

FiveT Fintech focuses on fintech and digital asset investments. Founded in 2018 and rebranded following a management buyout, it invests from early-stage to Series B. Leveraging a vast network of financial institutions, FiveT Fintech supports portfolio companies like Metaco and Coinfirm with strategic guidance and resources.

Key Info

Number of Investments

21

Number of Exits

3

Industries

Fintech

Investment Stage

Debt, Early Stage Venture, Initial Coin Offering, Venture

Year Founded

2018

More of the Zurich scene

Experience the community for yourself

Meet mentors and other professionals like you at our live events.