How Long Should You Bootstrap for Before Raising Funding?

Well, that is a loaded question!

Our opinion based on the +1,000 startups that have used this platform is that you should stay bootstrapped for as long as you can.

Looking for funding takes a lot of focus and time.

Consequently, your ability to focus on your core business suffers.

And when you’re at an early stage, you need to be on your A-game.

Beyond just being a huge time suck, a lot of people don’t realize how complicated things are going to get when you bring on investors.

- You’ll have to prepare quarterly performance reviews

- Answer to people that aren’t qualified to give opinions

- Generally be tied to the hip to people you don’t really know (or like)

Common retorts are that funding is required to pay for salaries, invest in R&D, scale quickly to build moats, and a wide variety of other justifications.

The problem is that most of the times funding isn’t the solution.

It’s just one of the solutions.

Alternatives to raising funding

Upskilling yourself and your team:

For example, instead of hiring a product manager, why not take a course on product management and learn the fundamentals so you can get by doing it yourself? Or instead of hiring an expensive SEO, PPC, PR, or other niche marketing specialist, learn it yourself. We overestimate what we are capable of in a day but underestimate what we’re capable of in a year. Investing the time early on to upskill yourself in multiple roles is the #1 alternative to raising funding since most of that money would go to pay salaries.

Get your hands on non-dilutive financing

This generally requires that you already are making decent recurring revenue.

Stripe Capital

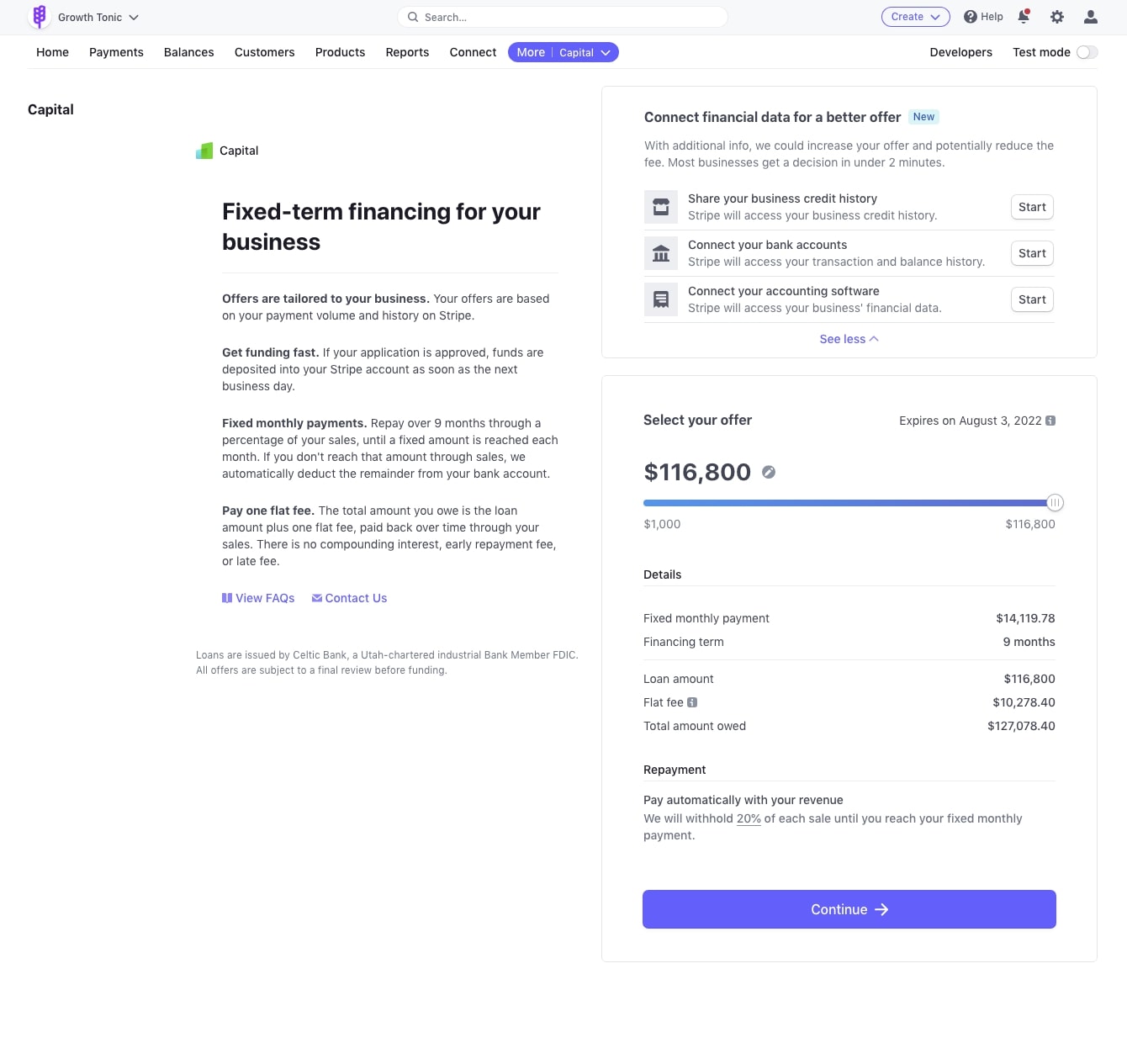

As an example, below is a screenshot of the offer GrowthMentor has on the table from Stripe.

For a flat fee of $10,278.40, Stripe will loan us $116,800 which is repaid through a fixed monthly payment. Stripe will withhold 20% of each sale until we reach the fixed monthly payment.

- 0% equity

- No annoying investors

- Just a straight cash deal

They get their “cut” and we get the advance.

Founderpath

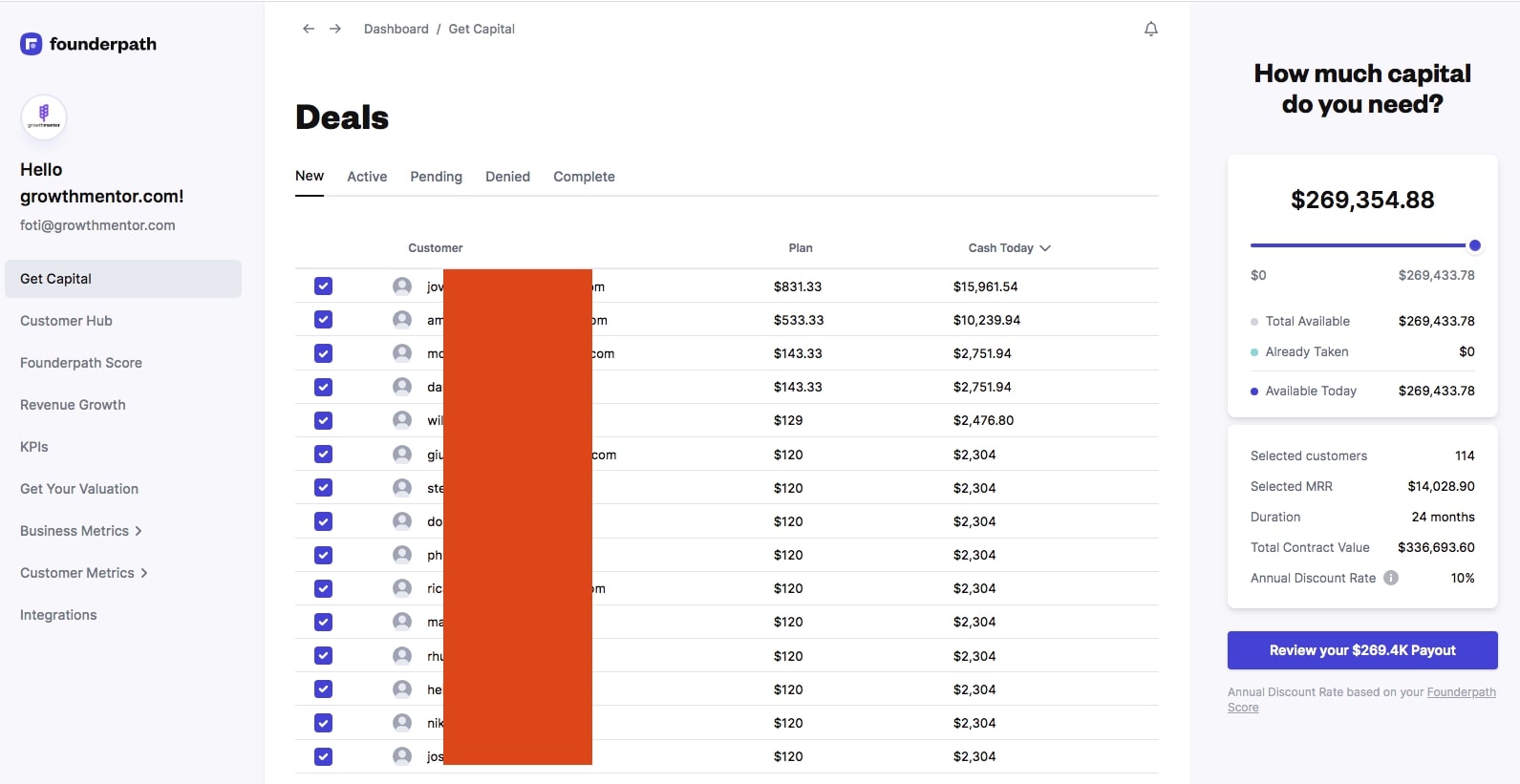

Founderpath is another option created by the notorious Nathan Latka.

The concept here is that you can “trade” your monthly recurring revenue for cash advances with a fixed discount rate.

On the surface, it might look expensive, but if you consider the fact that if these customers came to you requesting an upgrade to annual, you’d probably offer them a 20% discount, it’s not that bad.

Again, the goal here is to escape dilution and having to deal with investors pushing you around.

Below’s the offer I got from them.

Here are some other non-dilutive revenue backed financing platforms

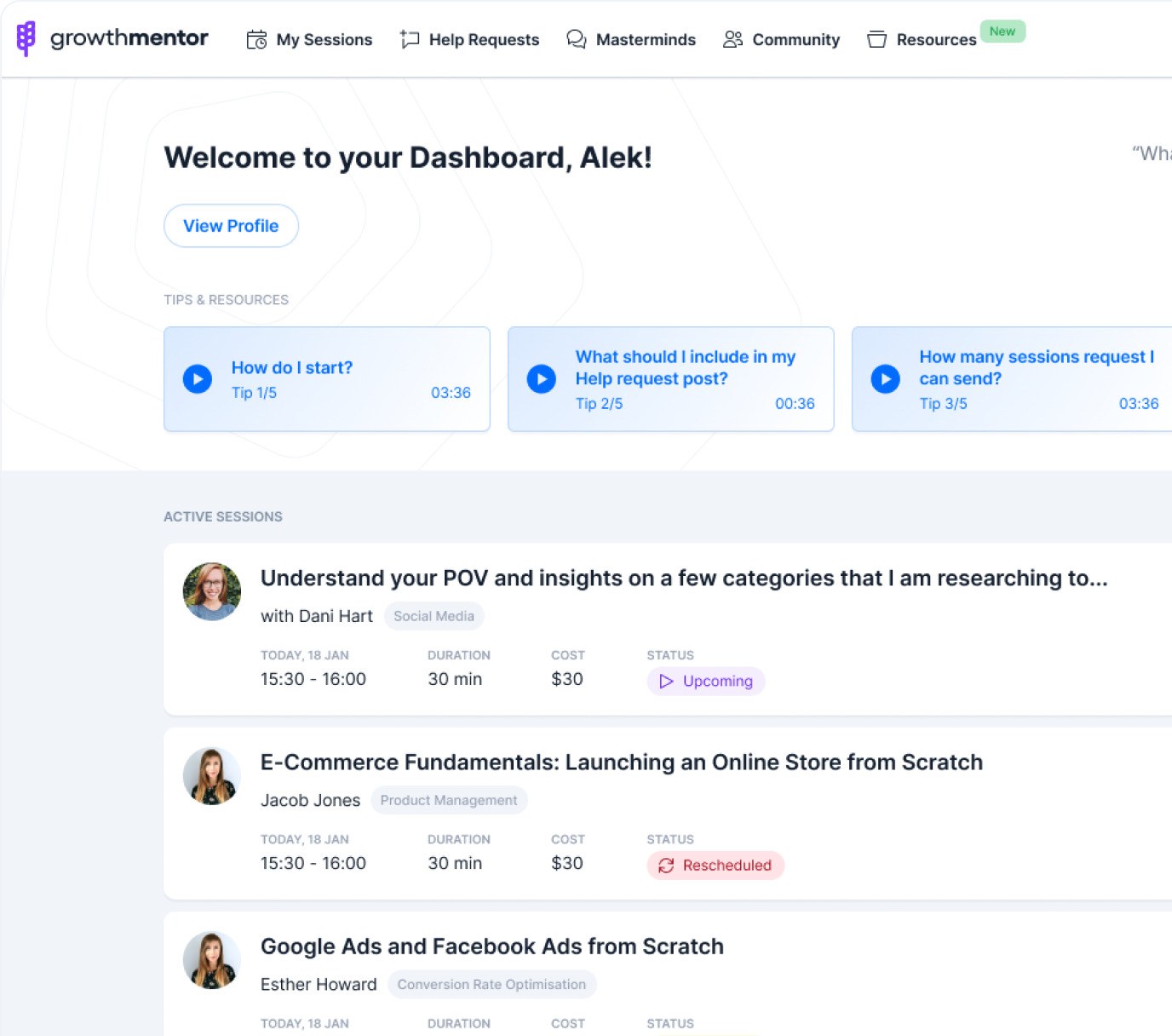

Many sessions have been booked about this topic on GrowthMentor, and it is something that really is best decided on a case-by-case basis.

Our Advice on Funding mentors will help you to weigh your options and share their experiences to help you decide which path to take towards raising funding or staying bootstrapped.