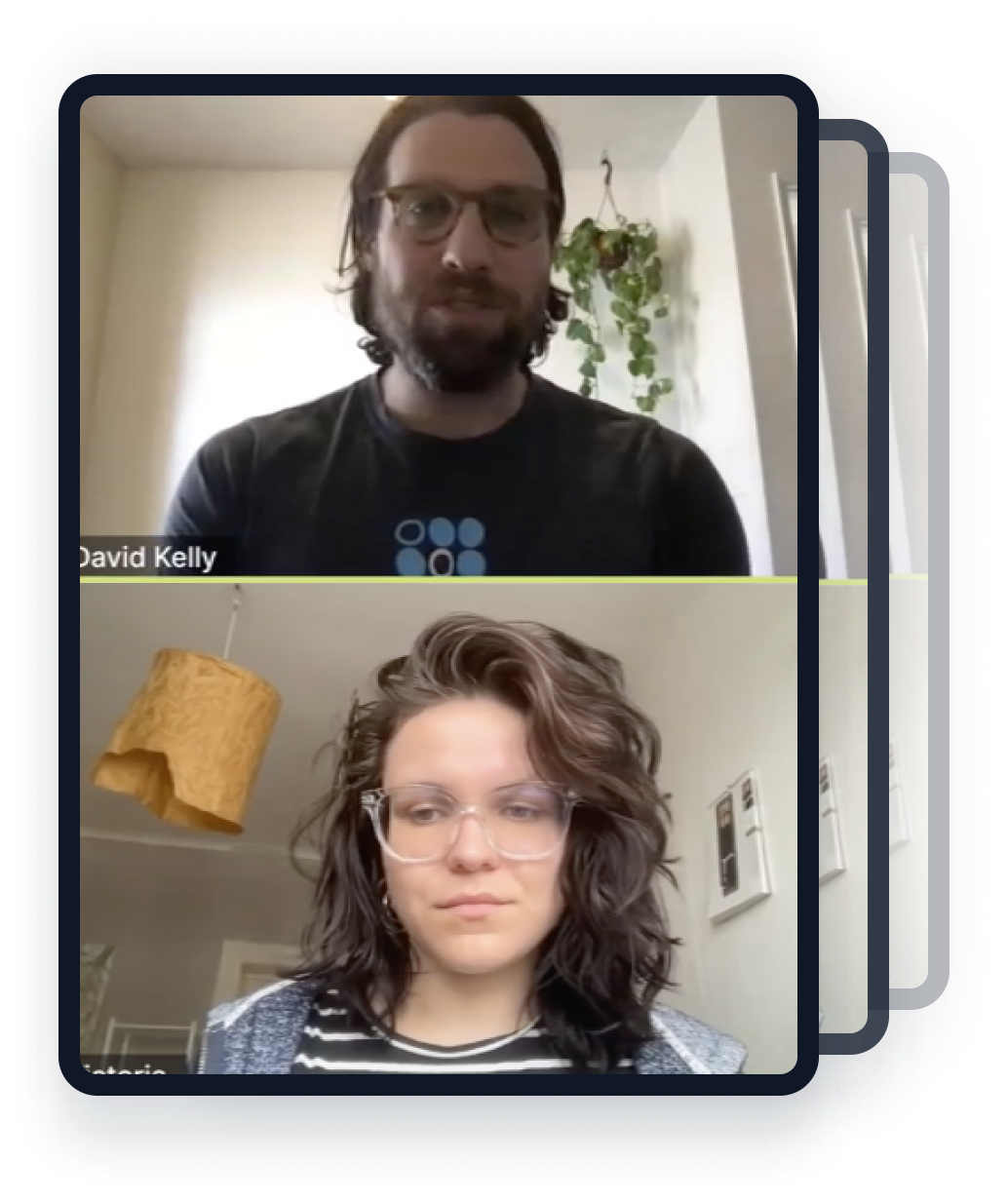

“It’s insane how I’m able to hop on Zoom calls with hundreds of experts that work at some seriously impressive companies!”

Speak to mentors who can consult you on your financial services business

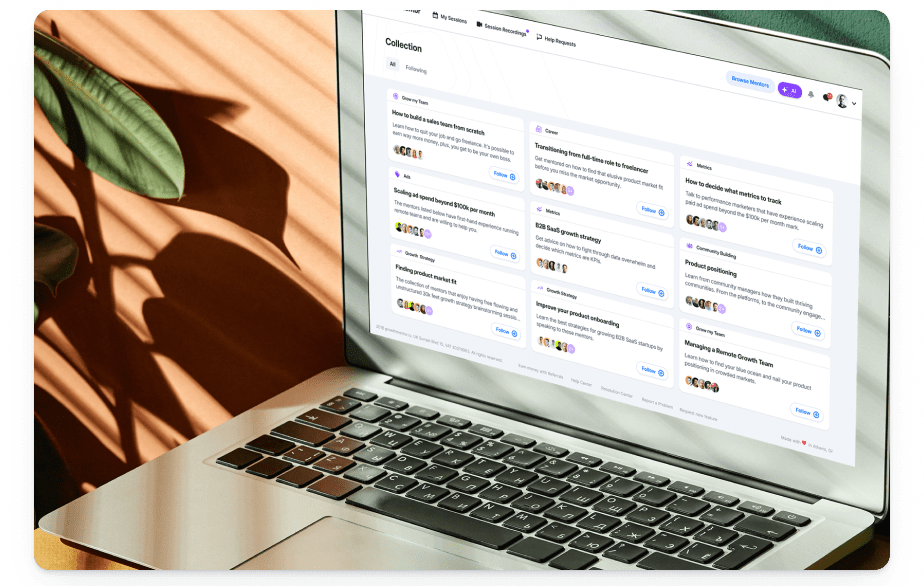

What would you like to get better at today?

Skip the consultants, embrace financial services mentorship

Connect with the right people and get unstuck

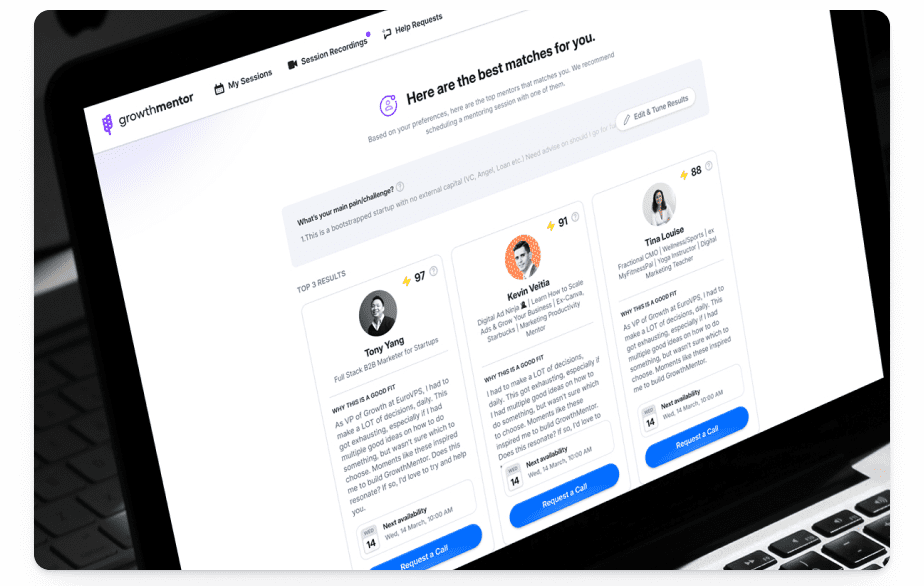

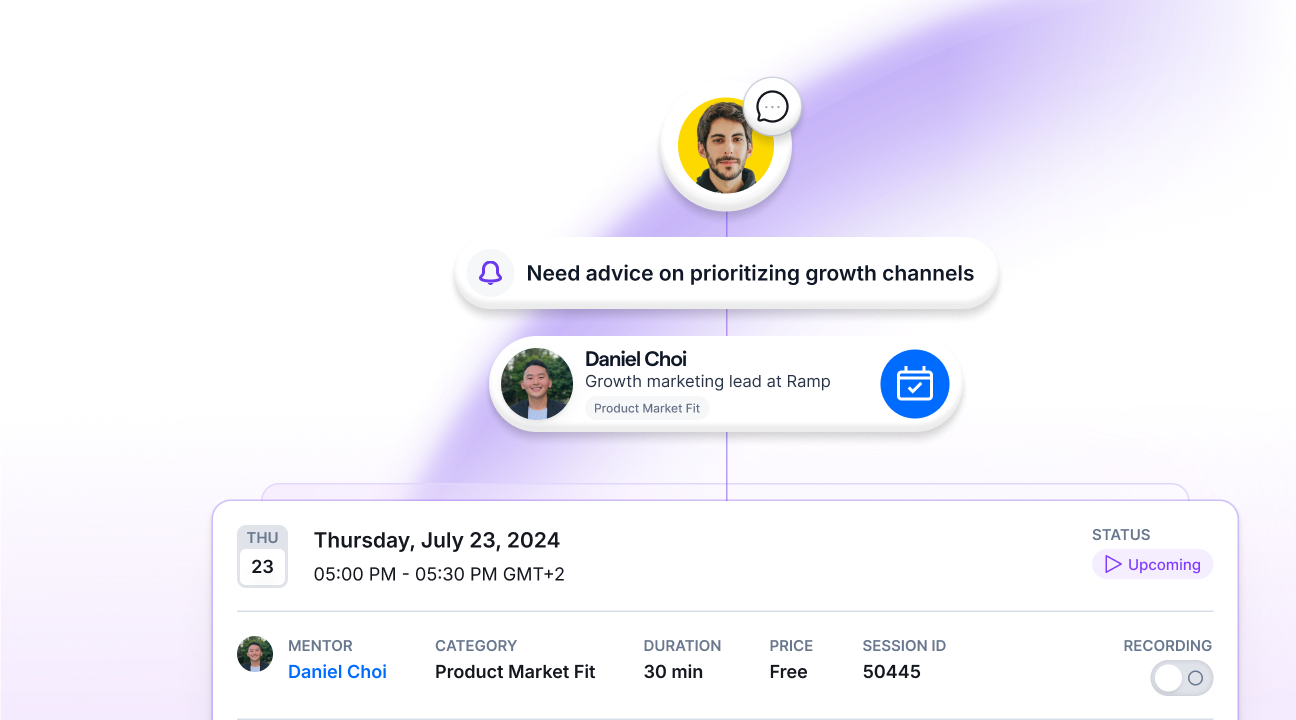

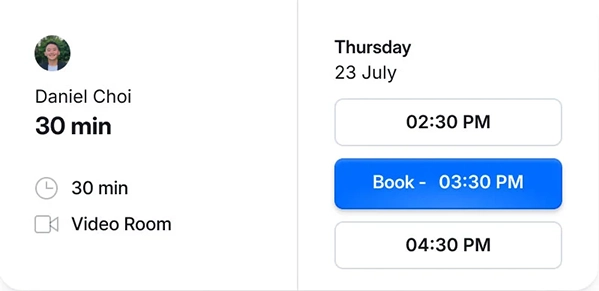

Find your mentor

Book a Call

Get unstuck

All your questions about mentorship, answered

What can a financial services mentor offer compared to a financial services consultant?

Typically, financial services consultants charge a high consulting fee.

But financial services mentors work by the “done-with-you” approach. This allows you to learn how to manage financial services on your own, eliminating the need for expensive consultants or agencies. Financial services mentors will focus on:

Cost-Effective Expertise and Support: Because mentors are passionate about helping others, they’ll provide you with support and advice for financial services without the steep fees.

Tailored Guidance: Your mentor will examine your specific situation and provide step-by-step walkthroughs of financial services operations.

Actionable Advice: A financial services mentor won’t leave you with a bunch of nonactionable theory. Instead, they’ll walk you through exactly how to start implementing their advice.

What can a financial services mentor do for me?

Most financial services mentors have handled numerous operations over their careers. Some have even been involved in financial services for years. These mentors have the real-world experience you need to give your operations an edge.

With a mentor’s advice, complex financial strategies will be less daunting. You’ll understand what impacts profitability, what regulations affect your services, and which strategies resonate better with clients.

For more advanced financial managers, a mentor can guide you through niche market strategies, detailed frameworks for risk management, and how to handle substantial financial investments. They can even share examples of successful financial operations for you to learn from.

So you can achieve greater profitability with less risk, training, and expense, regardless of your experience level.

Cost Comparison: Financial Services Consultants vs. GrowthMentor

When it comes to financial services consulting, traditional consultants typically charge between $100 to $200 per hour, depending on their level of expertise and reputation. And when you’re already investing in operations, costs can accumulate rapidly, especially for startups needing ongoing support.

In contrast, GrowthMentor offers a much more affordable and flexible solution. For just $99 per month, you gain unlimited access to dozens of financial services mentors. This fixed monthly fee means you don’t have to worry about hourly rates or unexpected charges for follow-up consultations.

Financial Services Consultants:

- Hourly Rates: Typically range from $100 to $200 per hour, depending on expertise and reputation.

- Total Cost: For multiple sessions, expenses can quickly mount, becoming burdensome for startups and small businesses.

GrowthMentor:

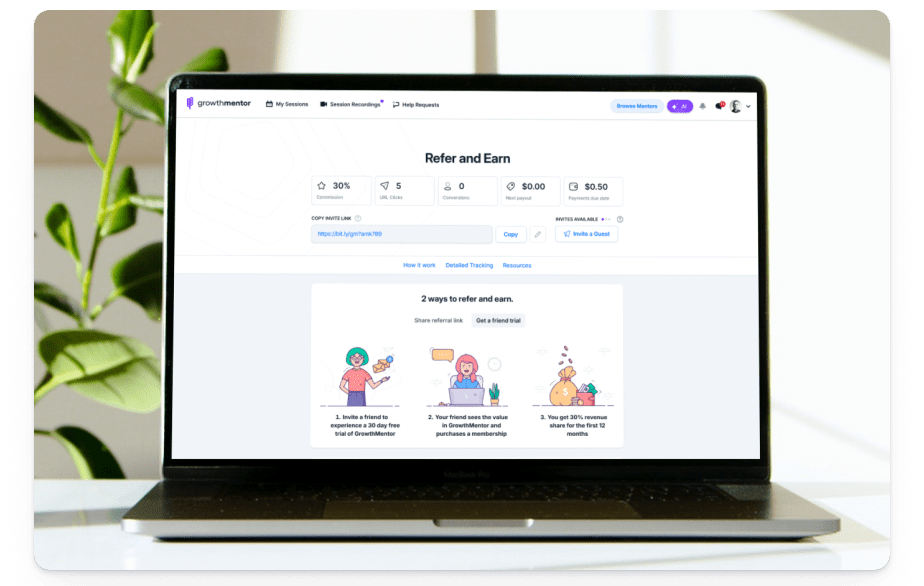

- Monthly Rate: $99 per month for unlimited sessions.

- Flexibility: GrowthMentor also allows you to connect with different mentors, rather than locking you into an exclusive contract with a consultant. You can engage with various experts and benefit from diverse perspectives.

By choosing GrowthMentor, you’ll receive continuous, tailored guidance from seasoned financial services professionals, all without the hefty price tag. This means you’ll have more funds to allocate towards your business operations instead.

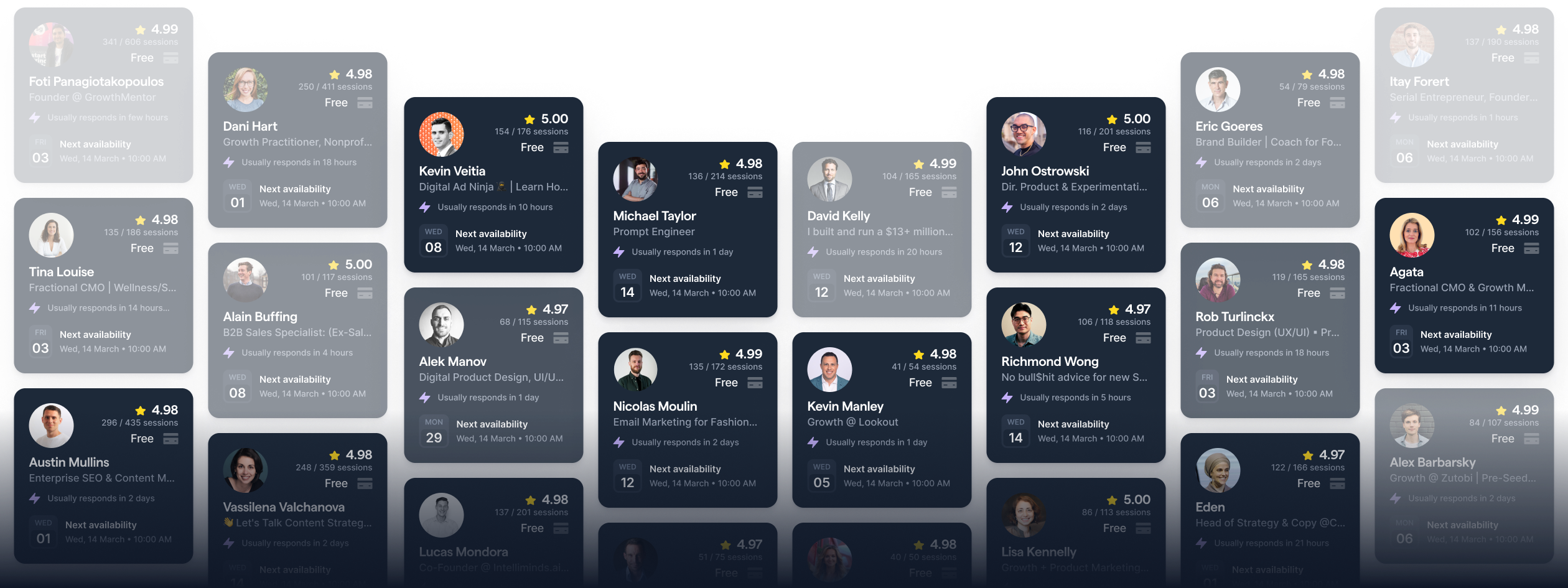

Why should I trust GrowthMentor’s mentors?

Excellent question. After all, the “mentorship” world is full of high-priced consultants, armchair analysts who have never done the work themselves, and outright snake-oil salesmen looking to make a quick buck.

But, there are plenty of experts out there who want to share their experience and knowledge. At GrowthMentor, we’re lucky to have 700+ of those experts.

The secret comes from our vetting process. We not only double-vet all of our mentors so only the top 3% makes it through our process, we also look at their soft skills. Because no one wants a mentor who’s a snob or a jerk.

On top of it, 85% of our mentors don’t charge an extra fee. Why?

The short answer: Because they want to help people.

The long answer is because…

- They enjoy sharing their knowledge

- They learn from their mentees

- They want to be a “force for good” in the business world

- They want to pay it forward

But don’t just trust our word on it. Hear from the mentors themselves.

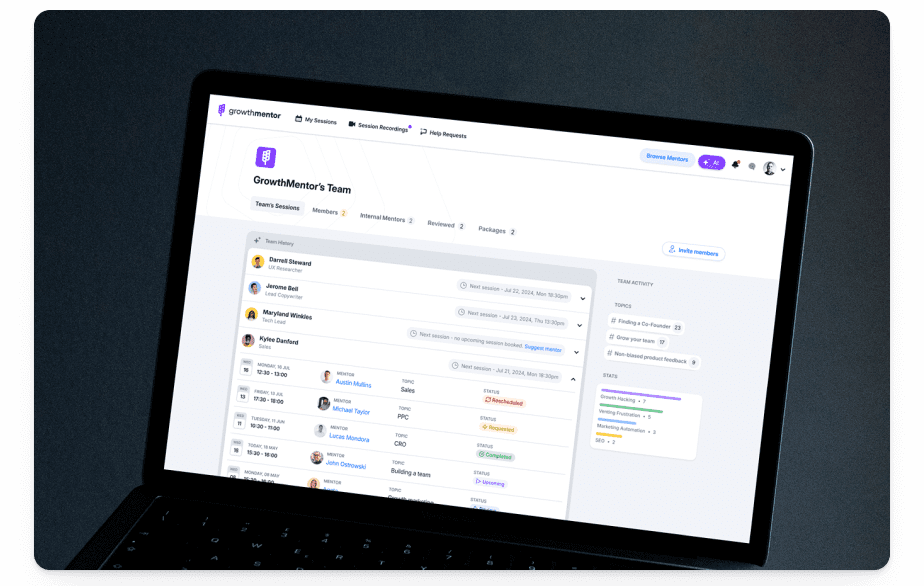

Join the most uplifting community on the internet

.pdf%20(1).png)