Download our list of The Top 100 Venture Capital Firms

This free sheet contains 100 VC firms, with information about the countries, cities, stages, and industries they invest in, as well as their contact details.

Cabiedes & Partners

Cabiedes & Partners invests in early to growth-stage technology, digital media, and fintech startups. Supporting companies like Blablacar, Privalia, and Trovit, they provide capital, strategic guidance, and mentorship, focusing on high-growth potential startups and leveraging an extensive European network.

Key Info

Number of Investments

160

Number of Exits

23

Industries

Finance, Financial Services

Investment Stage

Early Stage Venture, Late Stage Venture, Seed

Year Founded

2009

CB Rank

708,057

Centre for the Development of Industrial Technology (CDTI)

The Centre for the Development of Industrial Technology (CDTI) funds early to growth-stage industrial technology, biotech, and aerospace startups. They support numerous high-impact startups with funding and resources, focusing on technological innovation and industrial development in Spain.

Key Info

Number of Investments

140

Number of Exits

7

Industries

Finance

Year Founded

1978

CB Rank

153,929

Kibo Ventures

Kibo Ventures invests in early to growth-stage technology, digital media, and SaaS startups. Supporting companies like Flywire, Jobandtalent, and Carto, they provide capital and strategic guidance, focusing on scalable tech solutions and international growth.

Key Info

Number of Investments

114

Number of Exits

19

Industries

Finance, Financial Services, Mobile, Venture Capital

Investment Stage

Early Stage Venture, Late Stage Venture, Seed

Year Founded

2012

CB Rank

419,221

Alma Mundi Ventures

Alma Mundi Ventures invests in early to growth-stage technology, fintech, and insurtech startups. Backing companies like Clarity AI, CoverWallet, and Bdeo, they provide capital and mentorship, with a strong focus on innovation and a global network.

Key Info

Number of Investments

95

Number of Exits

8

Industries

Financial Services, FinTech, InsurTech, Venture Capital

Investment Stage

Convertible Note, Early Stage Venture, Late Stage Venture, Secondary Market

Year Founded

2015

CB Rank

110,245

JME Ventures

JME Venture Capital focuses on late seed and series A of Spanish companies with a technological base. Supporting companies like Redbooth, Jobandtalent, and Flywire, they provide capital and strategic guidance, focusing on high-growth potential and scalable solutions with active involvement in portfolio companies.

Key Info

Number of Investments

90

Number of Exits

8

Industries

Angel Investment, Finance, Financial Services, FinTech, Impact Investing, Venture Capital

Investment Stage

Early Stage Venture, Seed

Year Founded

2009

CB Rank

135,991

K Fund

K Fund is a venture capital fund backing founders across Southern Europe and Latin America, from Seed to Series B. K Fund invests in early-stage technology, SaaS, and digital media startups. Supporting companies like Factorial, OnTruck, and Exoticca, they provide capital and mentorship, focusing on seed and early-stage investments with a strong support network.

Key Info

Number of Investments

87

Number of Exits

8

Industries

Finance, Financial Services, Venture Capital

Investment Stage

Early Stage Venture, Seed

Year Founded

2016

CB Rank

112,942

Seaya

Leading European VC investing in exceptional entrepreneurs who build global tech companies. Seaya currently manages +€600M across 5 funds. Seaya Ventures invests in early to growth-stage technology, fintech, and digital media startups. Supporting companies like Glovo, Cabify, and Wallapop, they provide capital and strategic guidance, focusing on high-growth and market-leading companies.

Key Info

Number of Investments

86

Number of Exits

10

Industries

Finance, Financial Services, Venture Capital

Investment Stage

Early Stage Venture, Late Stage Venture, Seed, Venture

Year Founded

2013

CB Rank

105,313

Faraday Venture Partners

Faraday Venture Partners invests in early to growth-stage technology, healthcare, and digital innovation startups. With a member-driven investment model, they provide capital and mentorship, fostering growth in innovative tech and healthcare companies.

Key Info

Number of Investments

71

Number of Exits

6

Industries

Business Development, Financial Services, FinTech, Venture Capital

Investment Stage

Early Stage Venture, Late Stage Venture, Seed

Year Founded

2011

CB Rank

172,863

Axon Partners Group

A global firm focused on technology and innovation with two d investment and consulting. They invest in early to growth-stage technology, digital media, energy, and healthcare startups. Supporting companies like Cabify, Wuaki.tv, and Glovo, Axon combines capital with advisory services and market access, focusing on expansion in high-potential and emerging markets.

Key Info

Number of Investments

70

Number of Exits

12

Industries

Consulting, Venture Capital

Investment Stage

Early Stage Venture, Initial Coin Offering, Late Stage Venture, Post-Ipo, Seed

Year Founded

2006

CB Rank

133,551

Big Sur Ventures

Big Sur Ventures invests in early-stage technology, fintech, and consumer products startups. Supporting companies like Spotahome, Glamping Hub, and Adyen, they focus on disruptive technologies and scalable business models.

Key Info

Number of Investments

68

Number of Exits

2

Industries

Venture Capital

Investment Stage

Early Stage Venture, Seed

Year Founded

2011

CB Rank

178,599

Bonsai Partners

Bonsai Partners is a technology venture capital firm investing in both primary and secondary opportunities in tech startups from Europe. Bonsai Partners invests in early to growth-stage technology, SaaS, and digital media startups. Supporting companies like Idealista, Wallapop, and Glovo, they take a long-term partnership approach, focusing on high-growth companies.

Key Info

Number of Investments

67

Number of Exits

16

Investment Stage

Early Stage Venture, Secondary Market

Year Founded

2018

CB Rank

159,811

Samaipata

Samaipata is an early stage fund investing in digital businesses with network effects across Europe. Samaipata invests in early-stage technology, digital platforms, and e-commerce startups. Supporting companies like OnTruck, Spotahome, and CornerJob, they focus on digital platforms and network effects.

Key Info

Number of Investments

61

Number of Exits

5

Industries

Venture Capital

Investment Stage

Early Stage Venture, Seed

Year Founded

2016

CB Rank

130,692

Bankinter

Bankinter is a commercial bank with a Venture Capital program investing in startups. Bankinter invests in early to growth-stage technology, fintech, and healthcare startups. Supporting companies like Carto, Flywire, and Jobandtalent, they leverage corporate resources and industry connections to drive growth.

Key Info

Number of Investments

59

Number of Exits

10

Industries

Apps, Banking, Customer Service, Finance, Financial Services, FinTech, Insurance, Venture Capital

Investment Stage

Early Stage Venture, Late Stage Venture, Seed

Year Founded

1965

CB Rank

148,678

BeAble Capital

BeAble Capital specializes in early-stage investments in deep tech and industrial technologies. The firm focuses on bridging the gap between scientific innovation and market applications, supporting sustainable and industry 4.0 solutions to drive technological advancement and industrial growth.

Key Info

Number of Investments

53

Industries

Advanced Materials, Aerospace, Biotechnology, Chemical, Electronics, Laser, Medical Device, Nanotechnology, Neuroscience, Quantum Computing

Investment Stage

Early Stage Venture, Seed

Year Founded

2015

CB Rank

207,742

Cemex Ventures

Cemex Ventures, the venture capital arm of CEMEX, invests in construction tech startups aiming to revolutionize the industry. They offer funding, mentorship, and industry expertise, focusing on sustainability and efficiency.

Key Info

Number of Investments

31

Number of Exits

3

Industries

Venture Capital

Investment Stage

Early Stage Venture, Late Stage Venture, Post-Ipo, Seed, Venture

Year Founded

2017

CB Rank

167,412

Swanlaab Venture Factory

Swanlaab Venture Factory invests in B2B tech startups. They offer hands-on support and mentorship, focusing on market validation and scalability.

Key Info

Number of Investments

25

Number of Exits

2

Industries

Finance

Investment Stage

Early Stage Venture

Year Founded

2013

CB Rank

221,207

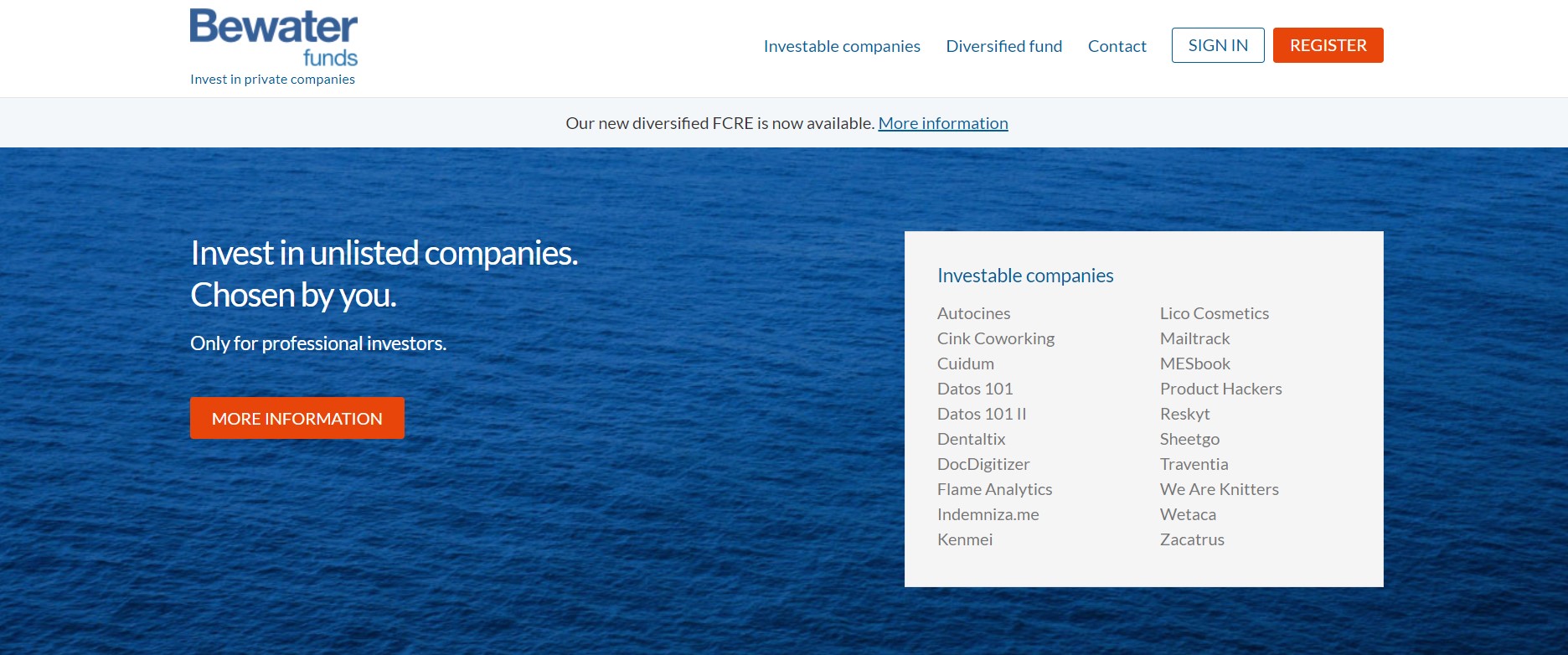

Bewater Funds

Bewater Funds specializes in secondary market investments, providing liquidity to shareholders of private companies. They emphasize transparency and investor protection while focusing on high-growth potential companies.

Key Info

Number of Investments

24

Industries

FinTech, Venture Capital

Investment Stage

Secondary Market

Year Founded

2014

CB Rank

72,230

Actyus

Actyus invests in disruptive fintech companies across Europe and Latin America, promoting financial inclusion and sustainability, backed by the international Andbank group.

Key Info

Number of Investments

24

Industries

FinTech, InsurTech, PropTech

Investment Stage

Early Stage Venture, Seed

Year Founded

2022

CB Rank

187,699

Fides Capital

Fides Capital invests in early-stage technology startups, providing capital and strategic guidance. They leverage a robust network of industry experts to drive innovation and growth.

Key Info

Number of Investments

23

Number of Exits

5

Industries

B2B, Consulting, Financial Services, FinTech, Venture Capital

Investment Stage

Early Stage Venture, Seed

Year Founded

1999

CB Rank

249,274

Conexo Ventures

Conexo Ventures specializes in cross-border investments, helping European tech companies scale in the U.S. They offer growth capital and strategic partnerships for global expansion.

Key Info

Number of Investments

22

Number of Exits

2

Industries

Cyber Security, FinTech, Information Technology, Venture Capital

Investment Stage

Venture

Year Founded

2018

CB Rank

192,345

Fondo Bolsa Social

Fondo Bolsa Social venture capital fund that invests into startups or new companies that generates positive social and environmental impact.

Key Info

Number of Investments

22

Industries

Venture Capital

Investment Stage

Seed

Year Founded

2020

CB Rank

212,489

Myelin VC

Myelin VC invests in early-stage biotech and health tech startups, offering mentorship and strategic support, with a focus on innovative healthcare solutions.

Key Info

Number of Investments

20

Number of Exits

2

Industries

Financial Services

Investment Stage

Early Stage Venture, Seed

Year Founded

2019

CB Rank

192,388

VitaminaK

VitaminaK invests in digital transformation and technology startups, providing seed funding and hands-on support to high-growth potential companies, driving market disruption and scalability.

Key Info

Number of Investments

18

Number of Exits

5

Industries

Angel Investment, E-Commerce, Venture Capital

Investment Stage

Early Stage Venture, Seed

Year Founded

2011

CB Rank

685,963

Rumbo Ventures

Rumbo Ventures backs early-stage startups with innovative business models across various sectors, offering capital and strategic guidance supported by a robust network of mentors and industry experts.

Key Info

Number of Investments

17

Industries

AgTech, CleanTech, Construction, Energy, Food and Beverage, Green Building, GreenTech, Industrial Manufacturing, Software

Year Founded

2023

CB Rank

174,387

Eatable Adventures

Eatable Adventures invests in early and growth-stage food tech startups, driving innovation in food technologies with capital and industry expertise, and supporting global expansion.

Key Info

Number of Investments

17

Industries

Food and Beverage, Hospitality

Investment Stage

Early Stage Venture

Year Founded

2016

CB Rank

206,684

VAS Ventures

VAS Ventures targets seed and early-stage tech startups, providing essential capital, strategic mentorship, and leveraging strong industry connections to scale high-potential companies.

Key Info

Number of Investments

17

Number of Exits

3

Industries

Finance, Financial Services, FinTech, Venture Capital

Investment Stage

Early Stage Venture, Seed

Year Founded

2017

CB Rank

293,616

Columbus Venture Partners

Columbus Venture Partners invests in early and growth-stage biotech and life sciences startups, offering capital and strategic insight, and leveraging strong research and industry networks for innovative healthcare solutions.

Key Info

Number of Investments

15

Number of Exits

2

Year Founded

2015

CB Rank

209,314

More of the Madrid scene

Experience the community for yourself

Meet mentors and other professionals like you at our live events.