Meet Nicholas from FlipGive

Q: Can you briefly introduce yourself and your company?

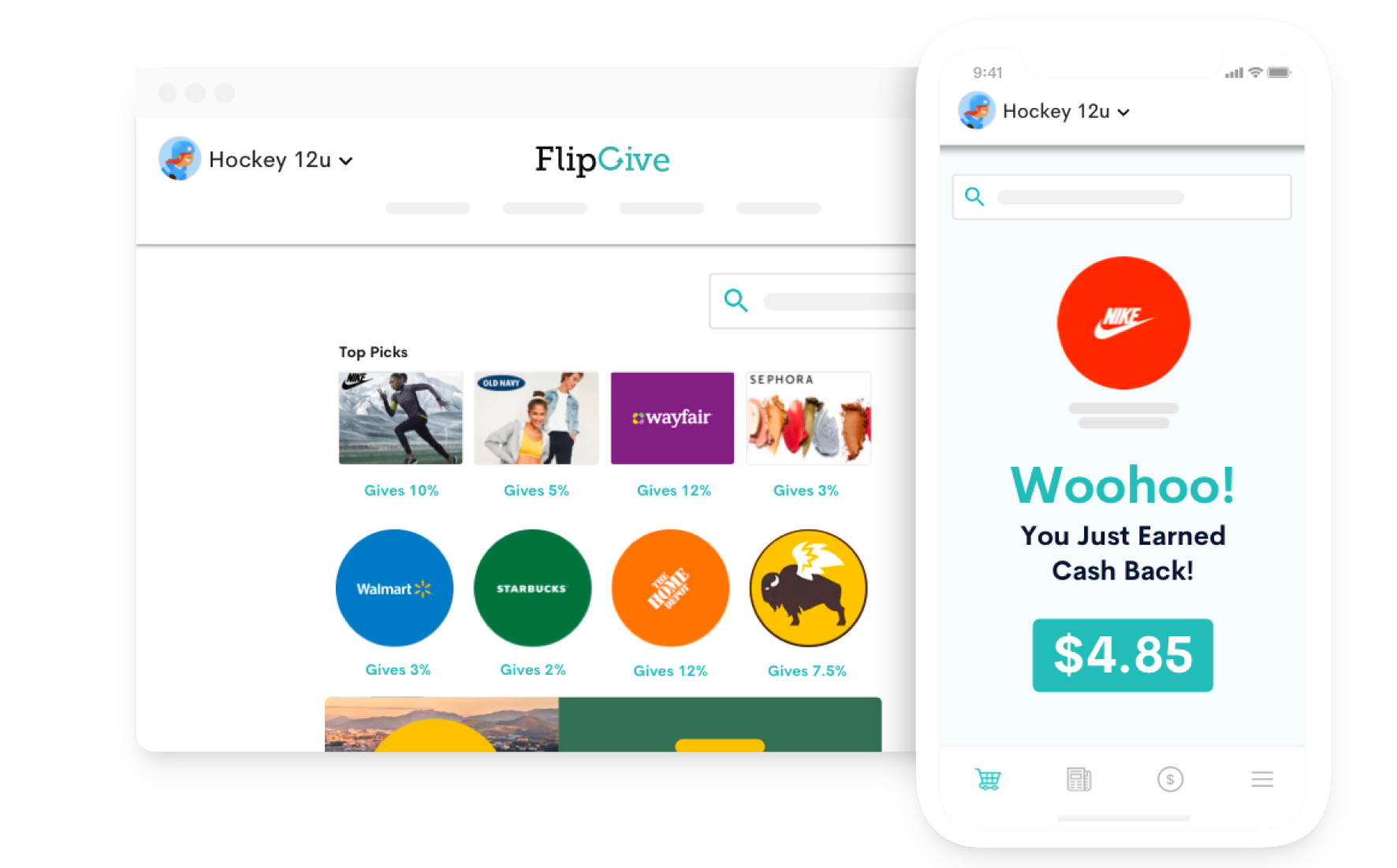

A: My name is Nicholas Lee. I am the CTO and co-founder of FlipGive, a loyalty program providing an alternative to traditional fundraising for sports teams, community groups, and schools. We’ve addressed the financial challenges associated with youth activities in North America for almost a decade. Parents often face the burden of spending up to $10,000 annually for their kids’ sports, covering expenses like equipment, travel, tournaments, and more. It’s a significant financial commitment that inspired us to create a solution.

Q: What motivated you to address the financial challenges in youth sports?

A: One of the challenges we noticed is the lack of support for children growing up, especially in the realm of youth sports. These activities play a crucial role in developing socially and physically skills. Currently, traditional fundraising methods involve selling overpriced items to family members, making it a time-consuming and inefficient process. We recognized the need for a better solution, leading us to leverage affiliate marketing and technology to create a loyalty program.

Q: What inspired this venture and the unique concept behind FlipGive?

A: It’s been quite a journey. Back in 2008, I was immersed in agency work and various tech startups, seeking a way to contribute positively to society. I explored the concept of B-Corps and benefit corporations, aiming to be part of a business that gives back. My initial venture delved into the nonprofit space, developing crowdfunding and social tools. However, we realized the challenge of soliciting direct donations due to the multitude of causes.

Encounter with 500 Global

Q: How did you come across 500 Global, and what prompted your decision to engage with them?

A: As we were transitioning into a marketplace environment and seeking investment, 500 Global emerged as a recommendation from our existing investors. What set them apart wasn’t just the capital infusion but also their comprehensive startup training boot camp. This program proved instrumental in reshaping how we approached the daily operations of FlipGive for sustainable growth. In those early days, the focus on a growth-oriented mindset was a significant learning curve, both for myself and Mark, our CEO at the time.

Q: Can you describe how you contacted 500 Global and initiated the dialogue that led to your involvement with them?

A: Our introduction to 500 Global came at a crucial juncture when we were actively seeking investment for our marketplace model. It wasn’t a random choice; our existing investors recommended them. What stood out was not just the financial support but the added value of a training boot camp specifically designed for startups. The dialogue began through our existing network, and the decision to engage with 500 Global was driven by the prospect of not just capital infusion but also gaining insights into running our company more effectively.

Typical Day in 500 Global and the Funding Journey

Q: What was your strategy for engaging with 500 Global?

A: The process involved a pitch at one point, although I wasn’t deeply involved in the setup. Our CEO took the lead during the pitch process. We underwent the pitch and got accepted as a group, securing both funding and entry into the accelerator space. While I can’t delve into the specifics of the process, it moved fairly quickly, orchestrated mostly by our CFO.

Q: Can you describe the process from initial contact to closing the funding round with 500 Global?

A: What I recall is that it progressed relatively swiftly. It was around our seed round, post-initial seed funding, where 500 Global participated as an additional contributor.

Q: What round were you raising for, and how much were you aiming to raise during your engagement with 500 Global?

A: This was pre-series A, part of our seed rounds. The exact amount escapes me as it was some time ago, but it followed shortly after our initial seed round. I believe the total raised in the seed round, including 500 Global’s participation, was around one and a half million dollars.

Q: With the investment from 500 Global, was it done in exchange for equity, and can you disclose the percentage?

A: Yes, the investment from 500 Global involved a small equity exchange. Unfortunately, I don’t have the specific percentage available at the moment.

Q: How long did it take to close the round, and what level of effort and time investment was involved?

A: In discussions during leadership meetings with our CFO and CEO, it became apparent that they managed the process quite efficiently. Closing the round didn’t pose significant challenges, and they had it sorted out within a couple of months. It didn’t seem overly complex.

Q: Apart from financial support, did 500 Global assist in any other forms?

A: The real game-changer was the boot camp they offered. While the monetary support was a relatively minor aspect, their holistic contribution extended to the training provided. This was immensely valuable for us, going beyond just the funds. I actively participated in the training sessions, and it played a crucial role in our growth.

Ongoing Relationship with 500 Global, Challenges, and Future Engagement

Q: How would you say your relationship with 500 Global has evolved since securing the investment?

A: We’re still part of the community, though there isn’t extensive interaction. We do maintain communication and extend their options into subsequent funding rounds, including Series A. Occasionally, they reach out for mentorship or meetings with other portfolio companies, offering advice to startups. While we’re happy to contribute, there haven’t been many activities in recent years.

Q: How have the insights and involvement from 500 Global influenced your approach to scaling and expanding your company?

A: The most significant impact they made was instilling a scale mentality in our business. Before their involvement, we approached growth somewhat haphazardly. Their guidance compelled us to think strategically, emphasizing product analytics, workflows, and metrics before implementation. This practice persisted, enabling us to achieve substantial year-over-year growth, even after the challenges brought by COVID-19.

Q: Can you share metrics regarding your growth, product offerings, or market presence post-contact with 500 Global?

A: After the boot camp around 2016 or 2017, we experienced remarkable growth for two to three years, maintaining a two to three times yearly growth rate until 2019. Focusing on the right elements within the organization for growth, we meticulously built and tracked our entire funnel. This strategic approach, coupled with the tools and processes they taught us, allowed us to prioritize effectively.

Q: Reflecting on your journey, what has been the most pivotal to your success, and what strategies have proven most effective?

A: One key strategy that significantly contributed to our success was the realization that optimizing customer acquisition cost (CAC) from a marketing perspective had its limits. The secret sauce for us lies in our focus on sports teams. By empowering one coach or team manager to bring on the entire team, we effectively divide our CAC by a significant factor. This approach, coupled with constant improvements in the acquisition process, played a crucial role in bringing us to profitability and sustaining our growth.

Final Advice on Contacting 500 Global and Fundraising

Q: Do you have any final advice for anyone considering contacting 500 Global or navigating the fundraising process in general?

A: At the end of the day, keep your pitch deck concise. Focus on clearly articulating the problem space your business addresses. Highlight that what investors bring to the table isn’t just funds but invaluable know-how on how to operate and grow. Demonstrating the potential of your business, coupled with a sharp focus on the market and its challenges, will significantly enhance the effectiveness of your initial pitch.