Introducing Kaylee Lieffers from Blanka

Q: Can you introduce yourself and your startup?

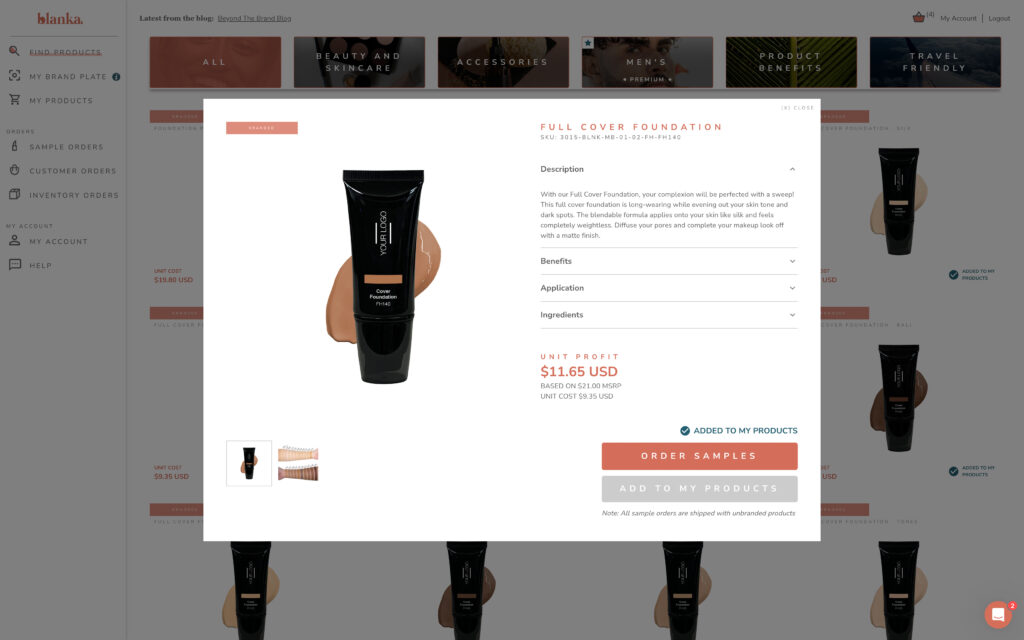

A: My name is Kaylee Leefers, and I’m the co-founder and CEO of Blanka. Blanka is a revolutionary platform designed to simplify the process of launching a branded product line in the beauty and wellness sectors. We provide technology that streamlines product procurement, personalization, and fulfillment for brands. Our service is unique because we require no minimum orders, and we offer a selection of high-quality products made in North America. These products can be sold on brands’ online stores without the need for them to hold any inventory. That’s a snapshot of what we do at Blanka and a bit about me.

Q: What inspired you to create Blanka?

A: My journey to founding Blanka was shaped by nearly a decade of experience in startups, where I gained extensive exposure to e-commerce marketplaces and enablement. I had the opportunity to build partnerships with major platforms like Shopify, Wix, WooCommerce, and even Alibaba in China. This experience opened my eyes to the dynamic nature of the e-commerce landscape, sparking my excitement about the possibilities in this space.

In 2020, I decided to leverage my understanding of e-commerce to launch my own brand, a sunscreen line, thinking it would be straightforward given my background. However, the reality was far from easy. I encountered numerous challenges, from sourcing suppliers and ordering inventory with high minimums to holding inventory and handling fulfillment. Each step was time-consuming and costly, ultimately leading to the venture’s failure.

This personal experience highlighted a broader challenge faced by entrepreneurs trying to bring a product to market. Specifically, in the beauty industry, where 25% of its global $430 billion market is dominated by emerging independent brands, there’s a significant gap in technological support for these entrepreneurs. This realization led me to create Blanka, aiming to provide a solution that supports these brands by simplifying the process of launching and managing a product line, eliminating the need for inventory holding and making the entire process more accessible and less costly.

Why Forum Ventures?

Q: How did you come across Forum Ventures?

A: My journey to Forum Ventures really highlights the power of networking, not just with investors, but especially with fellow founders. It all started with a conversation with another founder who was part of Forum’s portfolio. This individual shared her experiences, emphasizing the incredible support she received from Forum, particularly during her seed funding round. She spoke highly of the accelerator, detailing how it significantly aided in her business growth. Hearing such positive firsthand accounts about Forum’s impact and the level of support they offer really piqued my interest. This encounter happened back in the fall of 2022, marking the beginning of my connection with Forum Ventures.

Q: What was the application process like for Forum Ventures?

A: The route to joining Forum Ventures was somewhat unconventional for me. Rather than a traditional written application, my journey consisted of a series of engaging conversations. Initially, I spoke with an associate from Forum, which led to another discussion with a second associate. These discussions were followed by a thorough conversation with one of the Managing Directors, Bocar Dia, based in Vancouver. Throughout this process, which included a fourth conversation, I felt that they were thoroughly vetting us and performing due diligence before considering us for their accelerator program. The process wasn’t linear, leaving me uncertain about the number of meetings required or the next steps. To my surprise, during that fourth conversation, Bocar extended an invitation to join the program. This came as a shock because I was under the impression it was just another detailed discussion. My experience might have been a bit less formal compared to others, and honestly, I’m not entirely sure what the standard process entails, but that was our unique path into the program.

Funding Mechanics with Forum Ventures

Q: How does funding work once you join Forum Ventures?

A: Upon joining Forum Ventures, the funding process is quite direct and advantageous. Interestingly, my journey to Forum wasn’t in isolation; we were also exploring and had been accepted by a couple of other accelerators at that time. This gave us a broader perspective and the leverage to choose the best fit for our startup, which ultimately was Forum. Forum Ventures operates by issuing either $50,000 or $100,000 checks, based on SAFEs (Simple Agreement for Future Equity), although the specifics of the caps on these SAFEs escape me now. One critical aspect of their program is that every startup that passes through the accelerator receives funding. This straightforward and supportive approach was a significant factor in our decision to partner with Forum Ventures.

Choosing Forum Ventures Over Other Accelerators

Q: Why did you choose Forum Ventures over other accelerators?

A: The decision to choose Forum Ventures was influenced by several key factors. While we were considering multiple accelerators, including Techstars, Forum’s unique appeal ultimately won us over. Their specialization in B2B SaaS was particularly compelling for us. Even though Forum maintains a somewhat generalist approach, their slight inclination towards a niche aligned perfectly with our startup, Blanka. Another critical factor was the overwhelmingly positive feedback from other founders within the Forum network. Their experiences and the support they received painted a very promising picture of what we could expect. This, coupled with the strategic network opportunities Forum presented, was exactly what we needed. As a Canadian company aiming to penetrate the U.S. market and raise U.S. capital, Forum’s reputation and connections offered a significant advantage.

Indeed, leveraging Forum’s network and name enabled us to successfully close an oversubscribed seed round, validating our choice and highlighting the impact of aligning with the right accelerator for our specific needs and goals.

Inside the Forum Ventures Accelerator Program

Q: Can you share insights into what the Forum Ventures program entails and what a typical day looks like?

A: The structure of the Forum Ventures accelerator program is quite dynamic and tailored to the evolving needs of the startups involved. During my time, the program had a rolling start for companies, but I understand they’ve since shifted to a cohort model, enhancing the communal experience through shared progress with a consistent group of startups. A key aspect of the program is the personalized guidance each startup receives. In our case, we were fortunate to have Maia Benson as our managing director. Coming from a strong background in the Shopify ecosystem, Maia deeply understood our business and became an indispensable mentor, advisor, coach, and even a therapist at times. Our engagement included weekly hour-long deep dives into various business areas, where we received invaluable advice.

The program also offered diverse workshops twice a week, covering essential topics like pitch deck creation, GTM strategy, sales, and other areas relevant to all founders within the portfolio. This allowed for a customized learning experience, enabling us to engage with content that was most relevant to our specific challenges and goals. Spanning from my entry in September 2022 through February 2023, the program gradually focused more on fundraising as we approached the capital-raising phase. January was dedicated to finalizing and perfecting our pitch deck, followed by numerous pitch practice sessions. Forum facilitated introductions to various individuals within their network for these practices, ensuring we were well-prepared for the fundraising process that kicked off at the end of February. This comprehensive, mentorship-driven, and flexible approach was instrumental in navigating the complexities of startup growth and fundraising.

Standout Experiences in the Forum Ventures Program

Q: What are the standout moments or aspects of the Forum Ventures program for you?

A: The Forum Ventures accelerator program was characterized by its direct, no-nonsense approach, providing genuine advice and partnership through uncertain times. Two particular experiences stand out for me as emblematic of the program’s impact. Firstly, a pivotal moment came when I flew to New York to spend an afternoon with Maia, our Managing Director, focused entirely on strategizing how to scale our business. We dedicated a whole day in November to whiteboarding plans for enhancing growth in the months leading up to our fundraising. Maia’s willingness to invest such significant time and her insightful guidance were transformative, helping to shape our trajectory and approach.

Secondly, the emotional and strategic support provided during our fundraising phase was exceptional, especially when faced with external crises like the collapse of Silicon Valley Bank. This event dramatically affected the investment landscape and understandably caused a lot of stress. However, during this critical juncture, Jonah (General Partner) and Maia offered invaluable reassurance and advice, acting not just as VC advisors, but as therapists and confidants, helping to navigate through the challenges with a sense of confidence and calm.

This emotional intelligence and sensitivity to founders’ well-being were deeply appreciated. The Forum team’s genuine care for the individuals they work with extends beyond professional support; it cultivates lasting friendships and a community among participants. My upcoming trip to Austin, where I plan to meet with Forum team members, is a testament to the strong, personal connections formed during the program. This personalized, invested approach truly sets Forum Ventures apart, ensuring that while the program demands significant commitment from the founders, the rewards, both professionally and personally, are equally substantial.

Areas for Improvement in the Forum Ventures Program

Q: Have you identified any weaknesses or areas for improvement within the Forum Ventures program?

A: Reflecting on the program’s structure, the primary challenge I faced was the absence of a cohort-based model during my participation. This aspect made it somewhat difficult to forge deep connections with other founders, which is a crucial part of the accelerator experience. However, it’s worth noting that Forum Ventures has since addressed this issue by reverting to a cohort system. This change likely enhances the communal aspect of the program, fostering a stronger sense of camaraderie and mutual support among participants. In my view, this adjustment signifies Forum’s responsiveness to feedback and their commitment to optimizing the accelerator environment for current and future cohorts. Beyond this, I found the program to be exceptionally beneficial, with no other significant areas of weakness that stand out in my experience.

Key Takeaways from the Forum Ventures Program

Q: What are the most impactful lessons you’ve learned from the Forum Ventures program?

A: The Forum Ventures accelerator provided me with two invaluable insights that have fundamentally shaped my approach as a founder. First and foremost, the program demystified the process of fundraising, presenting a clear and effective playbook for securing a successful funding round. Before joining the accelerator, the intricacies of fundraising were somewhat of a mystery to me. The guidance and strategies I received from Forum were pivotal in navigating this complex landscape with confidence and purpose.

Additionally, the experience reinforced the principle that the value derived from any accelerator, Forum Ventures included, is directly proportional to the effort and engagement you invest. Success and growth aren’t simply handed to you; they require active participation, dedication, and a willingness to apply the lessons learned. This ethos of “you get out what you put in” is not only a testament to the structure and philosophy of accelerators like Forum but also a universal truth in the journey of entrepreneurship.

Measuring the Impact of Forum Ventures on Success

Q: Can you share a specific metric that demonstrates Forum Ventures’ impact on your company?

A: A tangible measure of Forum Ventures’ profound impact on our startup is the success of our oversubscribed seed funding round. Initially, we aimed to raise $1.5 million. However, with the guidance, preparation, and strategic insights gained from the accelerator, we were able to surpass our goal, raising $2 million USD. Remarkably, this entire process was completed within a tight timeframe of just 10 weeks. This achievement not only speaks to the effectiveness of the fundraising playbook provided by Forum but also highlights the accelerator’s role in significantly enhancing our appeal to investors and our overall preparedness for the fundraising journey.

Maintaining Connections After the Forum Ventures Program

Q: How has your relationship with Forum Ventures evolved since completing the accelerator?

A: Post-accelerator, my connection with Forum Ventures remains strong and supportive. While their current focus naturally shifts towards assisting the companies actively going through the program and fundraising phases, this hasn’t diminished our relationship. Understandably, the weekly meetings we once had are no longer necessary at this stage of our development, nor are they expected. However, the bond formed during the accelerator continues to thrive on a foundation of ongoing support. Whenever I reach out with a specific need or request for assistance, the response from Forum Ventures is invariably prompt and helpful. This enduring connection underscores the lasting impact of the accelerator experience and the genuine, ongoing commitment Forum Ventures has to the success of its alumni.

Advice for Prospective Forum Ventures Applicants

Q: Do you have any final advice for those looking to apply to Forum Ventures or similar accelerators?

A: For B2B SaaS companies, I firmly believe Forum Ventures stands out as the premier accelerator. The key to a successful application, especially considering Forum’s focus on pre-seed and seed stages, revolves significantly around the founder’s vision and the potential market opportunity (TAM). At this early stage, it’s less about the specifics of your business model or traction and more about the people behind the ideas. Forum Ventures places a high value on the founder, looking for individuals they view as backable and capable of making a significant impact in their chosen market. To those aiming to apply, it’s crucial to not only sell your idea but also to present yourself authentically, showcasing your unique qualities as a founder. Forum Ventures is particularly receptive to applicants who make a personalized connection, demonstrating they are real humans with genuine passion and vision for their venture. This personal touch can significantly enhance your application, aligning with Forum’s emphasis on the founder’s character and potential to succeed.